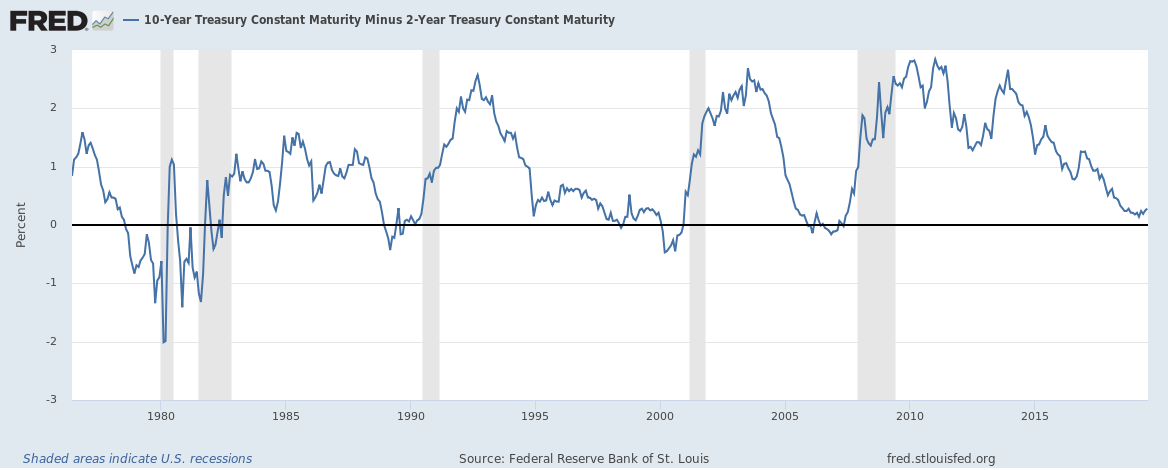

There are many indicators like PMI reports, jobs reports, inflation, industrial output, business sales, etc. that we take a look into in determining whether the US economy is slowing down and heading for a recession but there is one indicator, which we are not losing sight of, which is widely considered as the most reliable predictor of a recession and that is the yield difference between a 10-year U.S. Treasury bonds and a 2-year treasury bonds.

This chart from the St. Louis Fed’s economic dashboard shows that the spread has correctly predicted the last five recession. Every time before the US economy suffered a recession, the spread dipped below zero. Recession follows within 24 months, whenever spread dips below zero.

The spread has been steadily declining since 2014, as the U.S. Federal Reserve raised interest rates from 0.25 percent to 2.25 percent, pushing short-term rates higher, while lower inflation expectation pushed long-term yields lower.

However, there has recently been a shift upwards in this indicator, as the U.S. Federal Reserve signaled rate cuts. The upward shift further fades the possibility of an immediate recession.

Moreover, the U.S. GDP growth also suggests that the recession is still a far-fetched idea. Despite the recent slowdown, the U.S. economy grew by 3.1 percent y/y in the first quarter of 2019.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains