Technical roundup:

Lot of puzzling has been happening in CADCHF when we consider the intermediate trend of this pair, as per our previous post on technicals, the prices are going in sideways, and now it is time for CHF back again that all chances of recoveries, the major trend moving in sideways (see price actions in rectangular area), despite hammer pattern formation on monthly graph it don't seem to evidence upswings. However, a decisive breach above 7EMA (on monthly) can be deemed as the change in direction of the trend, so we advise to trade this pair with below option strategy recommendations.

OTC Updates and Option Strategy:

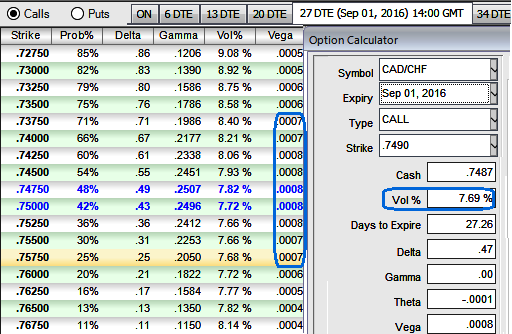

Currently the pair is trading at 0.7470 with the volatility of ATM contracts marginally creeping up (at 7.69%), we do not expect any dramatic price moves on either side but this should not create any harm for our currency portfolio nor do we want to miss the opportunity in even though underlying spot drifting in sideways. We believe CAD’s gain is majorly depends on crude’s strength which seems unlikely at this juncture.

While the sensitivity tool signals vega on both ITM and OTM strikes has been stable, so this is one more substantiation for no much sensitivity to the option prices in this tenor.

Whereas, the long-term path for Swiss franc would be determined by who sees inflation first: The SNB’s inflation forecasts extend out to Q3 2018, but extrapolating the last year of forecasts, it would take until Q3 2019 to reach the 2% target. Hence, the CADCHF in any near or medium term evidences dramatic swings on either side.

Hence, the recommendation would be on buying OTM -0.49 delta put while simultaneously shorting ATM put with similar expiries and buy OTM 0.5 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as CADCHF is perceived to have a low volatility.

The highest return for this strategy is achievable when the pair at expiration is equal to the strike price at which the call and put options are sold. At this price, all the options expire worthless and the options trader gets to keep the entire net credit received when entering the trade as profit.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields