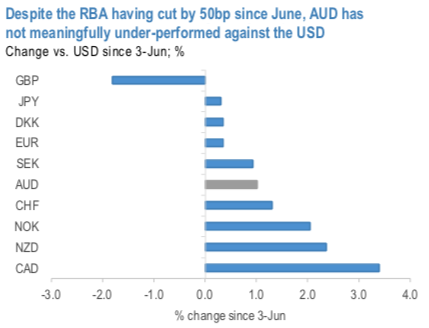

RBA being well ahead of the global easing cycle, AUD has not suffered meaningful under-performance (refer 1stchart). In part, this has been due to the relatively more dovish rhetoric from central bank officials in the US and Europe, which has muted the RBA’s ability to achieve much through the currency channel. Better external sector outcomes of late may also be supporting AUD; as 2ndchart illustrates, Australia’s current account deficit has narrowed to 0.6% of GDP as at 1Q’19, the best reading since 4Q 1979. This stands in contrast to current account dynamics in other G10 economies, which have broadly deteriorated in recent years (for example GBP, JPY, EUR, NZD).

G10 commodity currencies have generally outperformed since the inception of our NZDJPY bear put spread in May, and NZD is no exception. Still, NZD should be liable for protracted downside given a similar scenario of falling yields with a relatively-worse balance of payments position compared to AUD.

On top of that, the RBNZ has proven quite sensitive to global developments; this week’s testimony from Powell focusing exclusively on global uncertainty is likely to galvanize a response from the Bank. Indeed, their next meeting in August is live and is well-priced, but there remains potential to reload their easing bias to help draw down rates and FX further. 2Q inflation next week may present some event risk (consensus is for a rebound to 0.6% q/q, JPM 0.5% from 0.1% in Q1) but this ought not to deter the medium-term RBNZ path at this juncture.

The risk to these trades comes from an ongoing strengthening in high beta FX given a more dovish ECB and Fed stance. As discussed earlier, we partially hedge this exposure via short EURNOK.

The latest expression of long NOK exposure is expressed vs SEK in options in anticipation of a dovish Riksbank outcome as well as the standpoint on SEK reactions in various scenarios. The outcome of that Riksbank meeting ended up being on the hawkish side of expectations with the RB keeping its rate path unchanged in contrast to dovish market expectations, but we nonetheless retained exposure to the long NOKSEK view given cheap valuations and since the next Riksbank hike was still at least six months away and SEK still among the worst yielders globally. This rationale continues to hold and thus our medium-term expectation is still for NOK to outperform SEK.

The structure of the recommended trade (long 1m 1.0980 call; short 2m 1.08 put) warrants some tweaking. The call which is now ATM is now scheduled to expire next week leaving the trade very sensitive to interim volatility over this period. In the meanwhile, most of the residual value of the trade comes from the short 1.08 NOKSEK put (worth 16bp with 1m left to expiry).

Trade tips:

Long a 6m NZDJPY put spread. Paid 1.07% on 31st May. Marked at 0.51%.

Hold AUDCHF in cash, marked at -0.50%.

Given our bullish bias on NOKSEK, we continue to stay short the NOKSEK put. The short-term models puts NOKSEK fair value at 1.1050 given current oil prices and rate differentials (refer above chart). Courtesy: JPM

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated