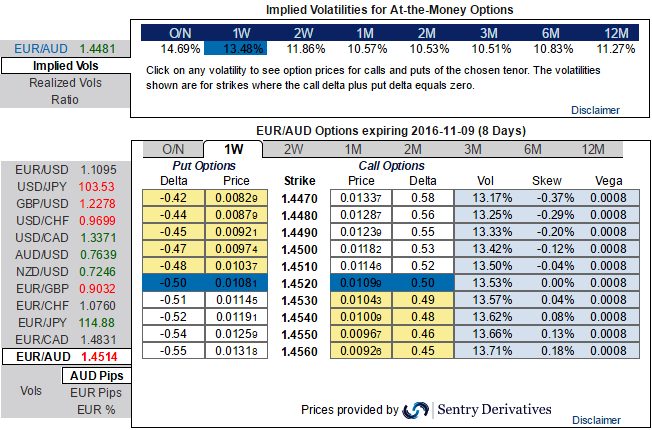

The implied volatility of ATM contracts for next 1m-3m expiries of this the pair is flashing at around 10.5%, that is when vital economic data events took place in the euro area.

Euro area composite PMI post a solid gain in October, signaling 1.8% GDP growth, but manufacturing PMIs have missed the forecasts (actual at 53.5 versus forecasts at 55.3).

The improvement was broad-based by sector and country and was reinforced by IFO and EC surveys.

Next week’s 3Q16 flash GDP report to show 1.5%q/q, SAAR growth, with modest downside risk.

October flash inflation report to show core inflation stuck at 0.8% oya.

From almost last two-three weeks we've been seeing the prices of this price sensing strength amid the major downtrend (see technical charts for EURAUD bottoming out from 1.4255 to the current 1.4477 levels).

If you consider long term euro's valuations then you would come across the convergence between spot curve and risk reversals.

EURAUD hedging and speculating sides as per OTC adjustments:

With spot FX flashes of EURUSD at 1.4477, IVs for 1w and 3m contracts have slightly shown a resilience in short run shrinking in the medium run. While positively skewed IVs of 2w tenors signify the OTC market sentiments towards OTM call strikes.

Hence, contemplating these OTC factors and synthesizing them with the technical trend and fundamental factors we understood the following fact.

The current spot prices are expected to show strength and travel upwards in next 1 months times but we are not jumping the guns to conclude this as the bullish reversal, In foreign exchange (FX) market prices move to extremes more frequently and these extreme levels is referred to as “Fat Tails”.

If more price actions occur at the fat tails, the option trader would mark volatility higher for out-of-money (OTM) and in-the-money (ITM) options then at-the-money (ATM) options and so does happen with EURAUD pair currently.

FX option strategies:

So, on both hedging and speculative grounds the strategy goes this way, go long in 1W ATM striking puts, while going long in 1M ATM strikes of 50% deltas.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand