Trump victory would probably maintain a high level of policy uncertainty – both the US and global. Investors indeed would wonder about the degree of implementation of his radical proposals: tax cuts and infrastructure spending threaten fiscal stability, while his protectionist and isolationist bias would hurt international trade and foreign direct investment.

Those threats, however, would largely be global rather than US-centric – the impact on the USD is less clear.

Trump’s victory would, in fact, prop up US corporation profit repatriation, while the looser fiscal policy would potentially direct to both a tougher Fed and higher long yields, potentially USD-friendly developments.

We are fundamentally bearish the lira but await better entry levels to go outright short again. The CBRT’s persistent dovishness and a widening current account deficit should fuel TRY weakness over the coming months, in our view.

This is likely to push TRY implied yields lower, making the lira the cheapest high yielding EMEA EM currency to short. Since Moody’s ratings downgrade of Turkey on 23 September, USDTRY is over 3% higher, but domestic FX selling at current levels is likely to cap near-term lira depreciation.

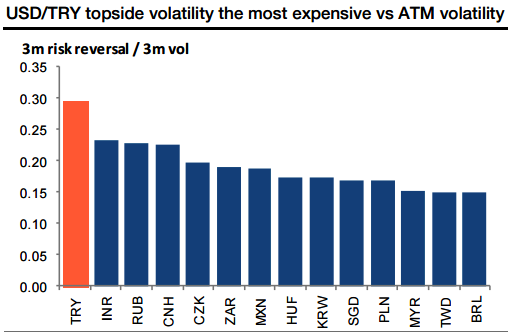

As a result of above fundamental factors, a rich USDTRY skew compared to implied volatility, the USDTRY is on the verge of all time highs and is a more appealing options hedge against a Trump victory versus other currencies.

ATM volatility returned to the non-distressed region (below 12), while topside exposure can be the most advantageously cheapened.

Among USD EMFX volatility smiles, the USDTRY 3m risk reversal is the highest compared with 3m ATM volatility, strongly suggesting dollar calls that sell topside skew.

The execution of the strategy: Buy 3m USDTRY call strike 3.16 knock-out 3.41, indicative offer: 0.67% (vs 2.34% for the vanilla, spot ref: 3.0936).

The risk is foreseen at a spike of +10% in the next three months Investors buying a knock-out call cannot lose more than the premium paid. However, the option will disappear if the USDTRY hits the 3.40 level at any time before the 3m expiry.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms