Positive factors less likely to drive CAD than draggers:

Trump’s protectionist declarations, notably labelling NAFTA as the “worst trade deal in the history of the country”, make the Canadian dollar especially vulnerable in the weeks ahead. Clinton has been ahead in the polls most of the time, but Trump is again catching up.

Clinton’s lead is less than two points, suggesting that the election outcome is likely to be very uncertain until the vote. The threat weighing on Canada’s status as a privileged trade partner should be increasingly discounted by FX markets.

In addition to that BoC’s dovish shift biases near-term CAD weaker: The BoC September policy meeting was dovish, as the bank significantly shifted the risk profile to inflation from “roughly balanced” to now “tilted somewhat to the downside”.

The commodity-related Canadian dollar was also hit by tumbling crude price on Friday due to reports that Iran's August crude oil exports jumped 15% to a five-year high of more than 2 million barrels per day, sparking fresh concerns over a global supply glut. Supply adjustment or an OPEC deal causes crude to pierce $60/bbl earlier than expected.

USDCAD has been trading sideways in a range for months but is currently testing an important resistance area. A decisive break of the 1.32 region would open the door for fast gains.

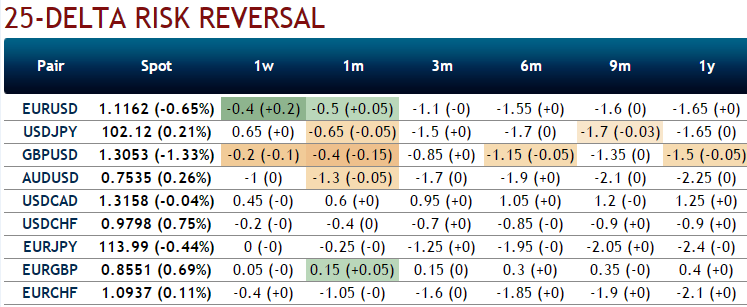

From the nutshell showing delta risk reversals of USDCAD, you can probably make out that the pair has been one of the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts which indicate upside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics