The US elections only matter for EUR/USD if Trump factor prevails. Although US policy outcomes are quite binary on most issues (taxes, spending, energy policy, immigration) depending on whether Clinton or Trump prevails, trade protectionism is core to both platforms; the only difference is the degree, with Trump being more extreme than Clinton.

Since the dollar has shown a tendency to undershoot fair value when the US creates trade friction with other major economies (like during the US-Japanese auto dispute in the 1990s and US-EU steel dispute in 2000s), the euro could overshoot the baseline forecasts around the US polls on November 8th.

If elected, we believe that Hillary Clinton would push for expanded trade deals, including a revised or modified the TPP-like agreement, albeit these deals would likely include increased protections for US workers, as well as expanded provisions for trade adjustment assistance.

On the other hand, Donald Trump, if elected, is likely to actively oppose any expansion of trade, and he plans to withdraw from TPP, direct the Secretary of Commerce and Treasury to identify violations of trade agreements and unfair trade practices, renegotiate NAFTA, and “use every lawful presidential power to remedy trade disputes.”

We continue to expect the euro to tick higher into 2017 despite Fed tightening, particularly given the ECB's misgivings about its QE programme. As occurred in the US before the Treasury taper tantrum in 2013, ECB QE has created a valuation and positioning problem that biases the euro to appreciate on even subtle changes in ECB policy.

OTC outlook:

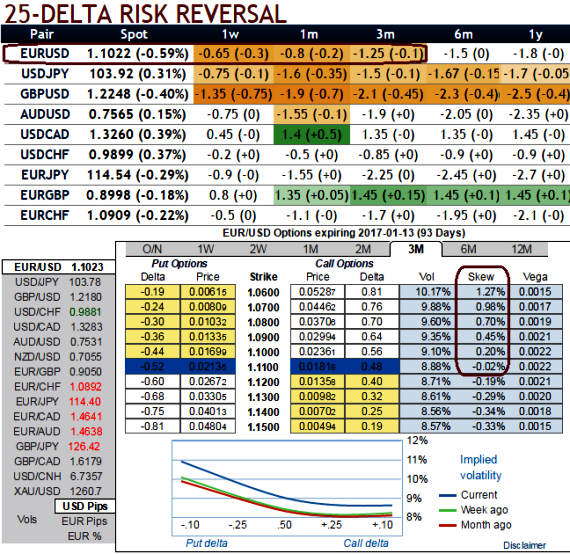

Please be noted that as the delta risk reversals increasing up progressively with negative numbers signify hedging sentiments are well equipped for downside risks during next 1-3m tenors.

While current IVs of 3m tenors are positively skewed towards OTM strikes but likely to perceive on an average of 9.5% in long run would divulge pair’s weakness (observe OTC market sentiments of bearish risks in 1w-3m tenors).

Hence, considering Euro's implied volatility and OTC market sentiments we reckon more downside risks are still on the cards in medium run, as result of deploying ATM delta instruments would be the answer for both speculation and hedging if you think speculation in potential uptrend in short terms is not possible as delta risk reversal suggested puts have been overpriced then use OTM puts that are available in cheaper premiums comparatively. But don't you dare to buck the trend and miss long opportunities in prevailing bear trend.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data