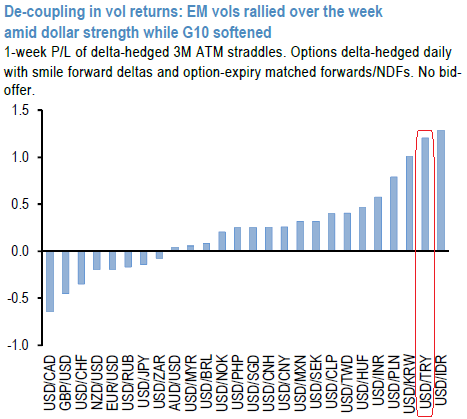

The push and pull of offsetting factors that had nudged us towards a more balanced view on vol were on full display this week. EM gamma spiked sharply as the shakeout in dollar shorts played out most violently in heavily-positioned in carry trades in EM and lifted delivered vol, but G10 vols fell as the sapping of bearish USD momentum prompted liquidation of USD puts, especially versus European currencies, USDTRY has been the pair to pop up the second highest vols (refer above chart).

Buy the tail Turkish lira implied volatility and risk reversals are among the highest in emerging markets. However, relative to recent history, they are not high in their own right.

The current 3m implied vol (12.5) could spike to the 16-20 area if accelerated depreciation did occur, while risk reversals could easily rise by 1-2 vol points.

This lends itself to owning volatility, and given the difficulty in ascertaining the probabilities of a “spike followed by a recovery” versus a “trend” move higher in USDTRY, we prefer a one-touch structure over a European digital.

The execution: Buy USDTRY 3m one-touch knock-in 4.35 Indicative offer: 10% (spot ref: 3.6684); Maximum leverage: 10 times.

Risks are limited to the extent of initial premium paid. The maximum loss is limited to the premium paid in the event that USDTRY does trade at, or above, the 4.35 strike at any time throughout of the life of the option.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025