Today’s GDP figure will be released at 8:30 GMT from the Office of National Statistics (ONS). It is the final reading of the fourth quarter GDP. The data is of extreme importance as it would represent the performance of the economy, which in recent days have raised concerns of a slowdown.

- The number, however, unlikely to be a key influencing factor for the pound and the FTSE100 as it is unlikely to be a major shift from the previous flash readings, which have confirmed a steady slowdown. In addition to that, the focus has now shifted to the politics of the Brexit. Data, other than GDP figure have already shown that the UK economy has performed better than expected after the referendum but has started slowing down since last year. While Retail sales, unemployment reports have been better than expected, weakness was visible in PMI reports and housing market numbers.

Past trends –

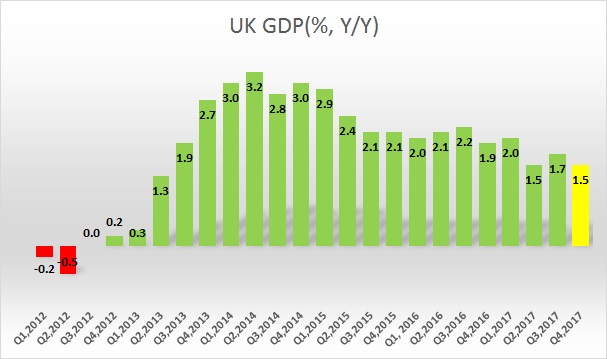

- After the 2008/09 crisis, the UK economy has been growing at the fastest pace among its OECD peers.

- GDP growth reached the highest level in the second quarter of 2014, reaching 3.2 percent growth on yearly basis. Since then, the growth has somewhat waned. In the last quarter of 2016, growth was 1.9 percent y/y.

- In 2017, the economy grew 2 percent y/y in the first quarter and by 1.5 percent y/y in the second quarter on an annual basis. Growth marginally improved to 1.7 percent y/y in the third quarter

Expectations today –

- Today, GDP growth is expected at 0.4 percent q/q and 1.4 percent y/y. Previous flash readings have flagged growth at 1.5 percent y/y.

Impact –

- The pound is currently trading at 1.409against the dollar. If the GDP growth disappoints to the downside, both the pound and the FTSE100 index would suffer selloff. The pound would suffer because a weaker economy would downplay the possibility of a hike from the Bank of England (BoE).

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022