The UK is in a major political trouble. In the last election, Prime Minister Theresa May’s Conservative Party fell short of an outright majority in the Parliament and is being forced to govern a minority government with the support from Ireland’s Democratic Unionist Party. In addition to that, the time is running out for the Brexit negotiations, which needs to be completed before March 2019. According to official communications, not much progress have been made in the first three rounds of talks. Several economic dockets released recently shows that the UK economy might finally be losing some steam, especially the housing sector. The first quarter GDP growth was much weaker at just 0.2 percent q/q, much lower than other European peers. Though it recovered marginally to 0.3 percent q/q in the second. Bank of England’s (BOE) inflation report forecasted tightening of inflation. It is very important to keep on assessing the economic well-being to understand the impact of this ‘first-time ever’ event.

One of the key measures of economic wellbeing is the unemployment report, which will be released from the United Kingdom today at 8:30 GMT. The reports released so far have showed no devastating impact from the Brexit referendum outcome. For today, the expectations are similar.

Below is the preview of the report -

- As of now, unemployment rate in UK stands at 4.4 percent and median estimate suggests it is likely to remain unchanged.

- So, the major focus will be on earnings growth, since that will be the measure of economic wellbeing.

- Moreover, a positive wage growth should help to downsize the fear of slowdown in the economy heading towards Brexit negotiations. It will be a nice evidence that companies are ready to increase wages even in the face of an exit from the European Union. BoE governor Carney said that the central bank would be monitoring the level of income closely, especially since the referendum aftermath upbeat economic performance was due to consumer spending and credit. Income levels directly affect these two components.

- Recently, there has been some weakness in the economic dockets such as the housing reports and the PMI reports. So, the market participants would be closely watching whether the earnings report reflect the same or not. Earnings report was weak last month.

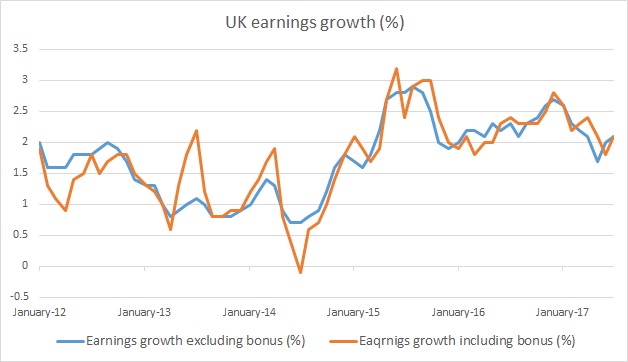

- After declining since October 2015 from 2.8 percent, wage growth has dropped to just 1.8 in February last year but recovered since then. After peaking in November last year around 2.8 percent, earnings growth have started slowing down once more. See chart.

- Today earnings growth is expected to be at 2.3 percent including bonus and by 2.2 percent excluding it.

The pound is currently trading at 1.332 and likely to move higher if reports turns out to be better than expected.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX