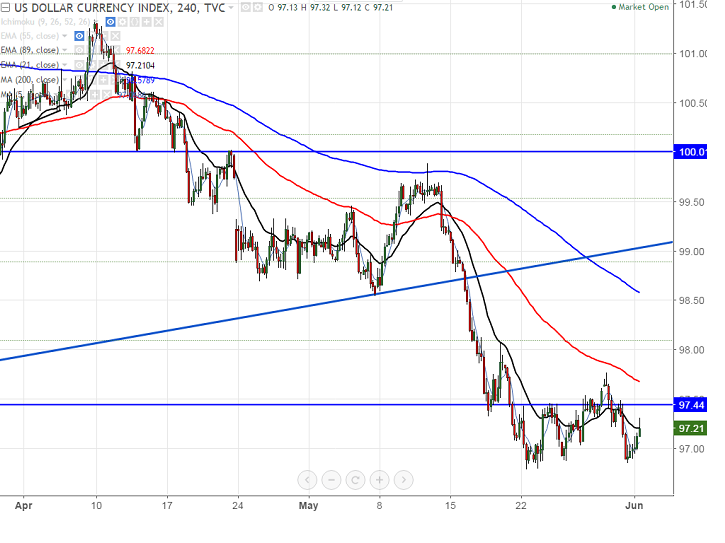

- US Dollar index has once again bottom near 96.80 and slightly recovered from that level. It is currently trading around 97.21.

- Short term trend is still weak as long as index not able to break above 98.08 (23.6% fibo). The index has shown a huge decline from the high 103.82 and downside capped by 61.8% fibo at 96.40 and bearish continuation can be seen below that level.

- The near term resistance is around 98.10 (23.6% retracement of 102.25 and 96.80) and any close above will take the index till 98.60 (support turned into resistance)/ 99.41 (200 MA)/99.89.

- On the lower side, major near term support is around 96.40 (61.8% fibo) and any break below will drag the index till 95.91 (Nov 9th 2016 low)/95.

It is good to sell on rallies around 97.70-97.80 with SL around 98.10 for the TP of 96.85/95.90.