Natural gas is currently trading at $2.77 per MMBtu.

Key factors at play in the natural gas market –

- Natural gas is looking to recover grounds, after finding support around $2.5 area once more.

- NATO sanctions on Russia might disrupt its gas supplies to Europe.

- Russia says world’s biggest pipeline for natural gas connecting China and Russia is almost complete.

- With geopolitical tensions rising between Russia and the United Kingdom and other European nations, the U.S. looking to fill in the shoes of Russia in terms of gas supply to the region.

- With natural gas turning into a buyers’ market, big importers like Japan are renegotiating long-term contracts with a resale clause attached.

- Russia and the United States are set to fight for market share in Asia and in Europe. US preparing to become major natural gas exporter to the EU and Asia.

- Australia looking to beat Qatar to become world’s largest Gas supplier.

- Large Natural gas producers in the United States continue to expand production per rig. US exports are increasing significantly.

- Qatar announced that it plans to increase output by 30 percent, which could be trouble for the US as Qatar is a low-cost producer.

- The United States remains the largest petroleum and natural gas producers in the world.

Now, for the inventory,

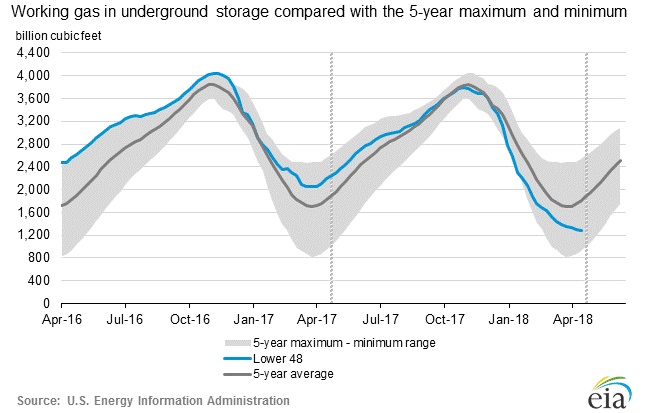

According to the latest numbers, working gas in the underground storage remains at 1.281 trillion cubic feet (Tcf). Stocks are 897 billion cubic feet (Bcf) lower than last year at this time and 527 Bcf below the five-year average. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly changes in inventory.

- Last week, the inventory declined by 18 billion cubic feet against an expectation of 11 billion cubic feet drawdown. Today 52 billion cubic feet build expected.

- EIA will release the inventory report at 14:30 GMT.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX