Natural gas is currently trading at $2.957 per MMBtu.

Key factors at play in natural gas market –

- The United States and Qatar signed a MoU to fight terrorism financing.

- Saudi-led Gulf group has confirmed that Qatar blockade would continue. Qatar is the world’s second-largest exporter of natural gas and the largest exporter of LNG.

- Speaking at Poland, US President Donald Trump said that the United States is planning to become an energy exporting country and called on Poland and other European nations to diversify its energy resources by taking advantage of the US energy boom.

- Qatar announced that it plans to increase output by 30 percent, which could be trouble for the US as Qatar is a low-cost producer.

- The United States remains the largest petroleum and natural gas producers in the world.

- We remain bearish on the natural gas outlook, with a target around $2.67 per MMBtu.

Now, for the inventory,

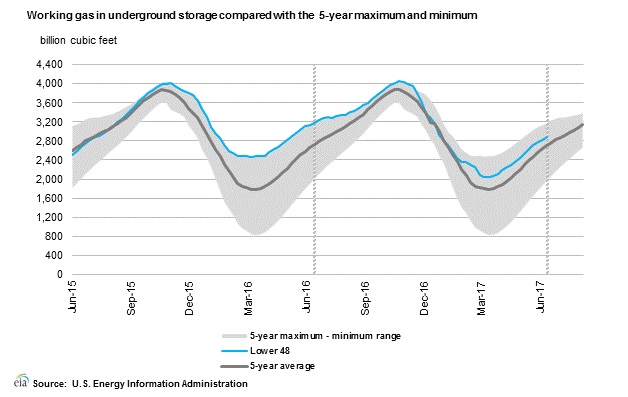

According to latest numbers, working gas in the underground storage remains at 2.888 trillion cubic feet. Stocks were 285 Billion cubic feet, less than last year at this time and 187 Billion cubic feet above the five-year average of 2,635 Billion cubic feet. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly changes in inventory.

- Last week, the inventory increased by 72 billion cubic feet against an expectation of 46 billion cubic feet. Today 59 billion cubic feet increase expected.

- EIA will release the inventory report at 14:30 GMT.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed