US equities made fresh record highs, helped by strong company earnings, and the US dollar rose. US bond yields, in contrast, were weighed down by Catalonia’s declaration of independence plus Fed Chair candidate Powell’s increasing favorite status, events which dominated s strong GDP report.

Euro Area: Oct business surveys are released with both the economic confidence index and the business climate indicator holding elevated levels through 2017 – last at 113.0 and 1.34 respectively. The final Oct consumer confidence read follows another increasingly positive flash estimate of -1.0.

Germany: Oct CPI is released ahead of Tuesday’s Euro Area-wide result. Annual inflation was last at 1.8%, above the Euro Area’s 1.5% pace.

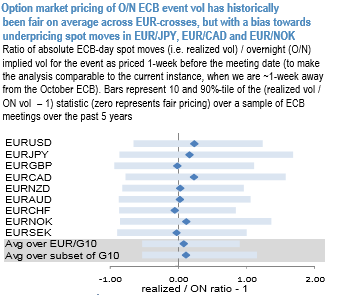

One aspect of short-dated EURUSD vol surface pricing that does strike us as anomalous is the cheapness of forward volatility priced for after the ECB meeting.

The above table shows that the event vacuum after the October ECB is reflected in a1 vol+ rolldown of 1M ATM vols post meeting.

The absolute level of the forward vol matters too: 6.1 as the forward level of EURUSD 1M ATM vol after the meeting date at the time of writing is extremely low and has rarely been reached let alone sustained judging by the history of EURUSD 1M vol in recent years (refer above chart).

Additionally, Euro spot has been realizing 6.0 -6.5% in recent weeks even in a quiet market, so there is no risk premium priced into forward vols for any unexpected dollar volatility brought about by either a re-pricing of Fed expectations or more trade/NAFTA/fiscal noises out of Washington.

Owning post-ECB forward vol is therefore much better risk-reward in our view than buying the event itself.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing positive 119 (which is bullish), while hourly EUR spot index was at a tad below -54 (bearish) at 07:05 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary