OTC outlook:

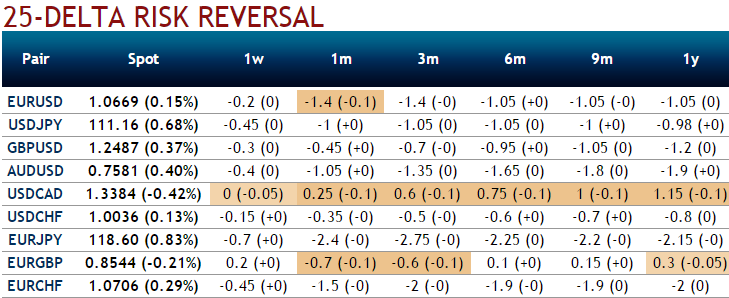

Please be noted that it seems to be ideal time for the writers of overpriced call options as you could observe the negative shift in risk reversal flashes in 1m tenors, whereas we see neutral changes to the mild bullish risk sentiments across all tenors, as a result, CAD seems to be losing its strength in next 2 months tenor, on the contrary, USD’s robustness in Q2 on fed’s hiking hopes June meeting seems more attractive than CAD.

Moreover, all these factors are discounted in FX options market, you could observe this in implied volatility skewness.

You could make out this in mounting upside risk sentiments as you could see the positively skewed IVs in OTM call strikes. Hence, long positions in ATM instruments seems attractive for holders of the calls as the Vega is generally larger in options which have the longer time until expiry, and it falls as the option approaches expiry.

This is because an increase in IV is more beneficial for a longer term option than for an option that would expire in shorter tenors.

The Vega is at its maximum when the option is ATM and declines exponentially as the option moves ITM or OTM.

Well, these positive skews in 2m implied volatilities suggest RKO calls on both hedging as well as speculative grounds; the USDCAD 2-3m skew has been well bid with Trump progresses in the beginning months to come, lifting it to its highest level since June 2015.

We reckon the above fundamentals seem to be reasonably addressed by hedging participants, hence, we advocate below option strategy to mitigate risks on either way with cost effectiveness.

Hedging Strategies:

We recommend initiating longs in 2 lots of 1M ATM +0.51 delta call, and simultaneously short 1 lot of OTM call (1%) with comparatively shorter expiry in the ratio of 2:1.

So, trading option spreads in different strikes allows the traders in many tricky market scenarios and likely to fetch positive cashflows.

The lower strike short calls seems little risky but because IV responds adversely, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are reasonably priced, so we loaded up with the weights in the spreads) and the position is entered for reduced cost.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics