We could foresee a bullish scenario of USDCAD above 1.43 driven by:

1) The US moves ahead on border adjustments or NAFTA negotiations turn sour;

2) US-Canada trade negotiations turn acute and negative with a proliferation of high-profile trade enforcement actions by the US;

3) Commodity prices fall much further on China/global growth concerns;

4) Wobbles in the housing market cause a broader instability in the financial system.

OTC Outlook and Options Strategy:

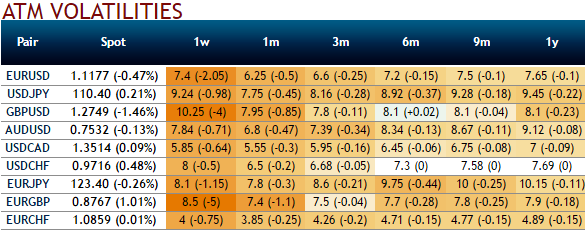

Please be noted that the above nutshell showing IVs and risk reversals of this pair, has been neutral. Implied volatilities have been extremely lower (least among the G7 FX space) and you could also make out that there have been no hedging sentiments (neutral risk reversals in 1w tenors and with bullish neutral hedging sentiments in 1m-1y tenors).

Contemplating these OTC indications, using this option strategy, the investor gets to earn a premium on writing overpriced calls while at the same time appreciate all benefits of underlying spot outrights moderately.

If he’s having FX payables unless he is assigned an exercise notice on the written call and is obligated to sell his spot outright holdings, this strategy is a risky venture.

This is a suitable strategy where the moderately bullish investor sells out of the money calls against a holding of the underlying spot outrights. The OTM covered call is a popular strategy as the investor gets to collect premium while being able to enjoy capital gains (albeit limited) if the underlying spot FX rallies.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts