The bearish USDCAD scenarios (below 1.28) driven by:

- BoC indicates the intention to normalize rates earlier due to an improved global outlook.

- Global demand pushes oil prices to $50 plus and towards $60.

The Bank of Canada has been signaling an imminent rate hike, if not in the July meeting then in September, and this is now priced in. The BoC is giving greater prominence to financial stability concerns stemming from high Canadian household indebtedness and regional housing booms. Although our early 2018 target for USDCAD has been reached, the loonie’s undervaluation should support further appreciation in the months ahead.

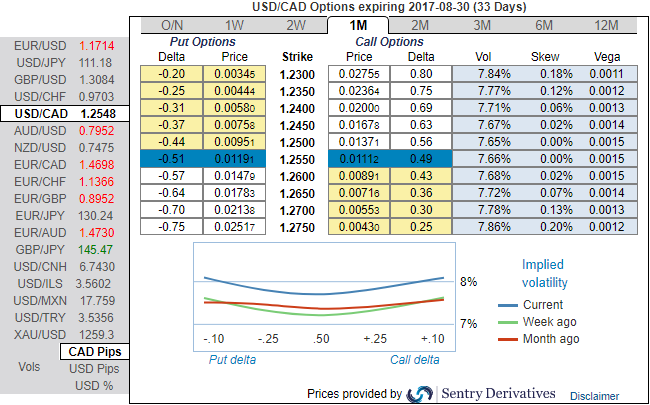

In the recent times, CAD vols skews destabilized too much especially on crude’s price sustainability, while USD volatility market normalized sharply (you could observe that in USDCAD IV skews) which has been well balanced on both the sides. The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the option market aggressively unwound smile positions.

While the implied volatility remains among the three lowest G10 vols, seeming options globally inexpensive. Despite the recent CAD appreciation, the USDCAD realized volatility has remained muted due to the low realized vol environment which makes knock-out barriers attractive.

Two-month USDCAD absolute moves observed on a daily basis since 2013 has been 88% smaller than the current distance between the spot and the KO barrier (690 pips). This makes the KO event unlikely. Risks are limited to the extent of premium. If USDCAD spot hits the 1.23 barrier at any time before the 2m expiry, the option will expire instantly. Hence, USDCAD 2m put strike 1.27, knock-out 1.23 Indicative offer: 0.20% (vs 0.48% for the vanilla, spot ref: 1.2548).

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios