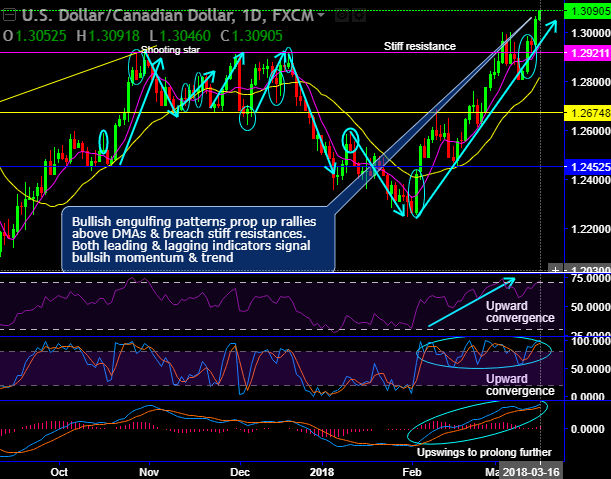

Chart and candlestick patterns: Frequent occurrence of bullish engulfing patterns pop up at 1.2963 and 1.3087 levels and these bullish patterns prop up rallies well above DMAs and EMAs. In this process of upswings, the bulls manage to break-out the stiff resistances of 1.2920 levels and establish 8 and a half months highs (refer both daily and weekly chart).

While both leading oscillators (RSI & stochastic curves) show upward convergence that signal buying pressures.

To substantiate this buying sentiment, trend indicators are in conformity to the uptrend, bullish DMA and MACD crossovers signal upswings to prolong further.

Where the price rallies in intermediate trend, broke-out stiff resistance, now on the verge of retracing 61.8% Fibonacci levels, the bullish sentiment backed by both leading & lagging oscillators on this timeframe too.

The next immediate stiff resistance is seen at 1.3129 levels and the strong supports are seen at 1.30 and 1.2911 levels.

Trade tips: At spot reference: 1.3087, contemplating prevailing bullish sentiments one can buy double touch binary calls (1.3129) to leverage payoffs. The magnified yields are most likely if the underlying spot FX keeps spiking upto above stated strikes of 1.3129 (i.e. means another upward journey of 30-35 pips).

Well, on hedging grounds, one can keep the potential bullish risk of this pair on the check by adding long positions in futures contracts as the underlying spot FX has constantly been rising from the lows of 1.2247 levels to the current 1.3066 levels. The long futures position of mid-month tenors are advocated with a view to arresting further upside risks, we reiterate that it is wise to use dips to deploy long hedges using the derivative contracts.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -107 levels (highly bearish), while hourly USD spot index was at 52 (bullish) while articulating (at 11:51 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: