USDCAD forms back-to-back shooting stars at 1.2847, 1.2791 and now potentially at 1.2750 levels on weekly plotting that hampers previous consolidation phase and bears have resumed in the major declining trend.

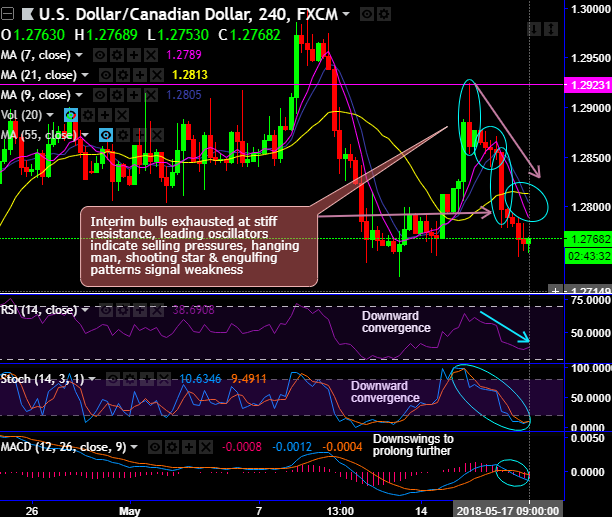

Shooting star, hanging man and bearish engulfing patterns have occurred on intraday plotting at 1.2860, 1.2857 and 1.2797 levels respectively (refer 4H charts).

As a result, the price tumbles below DMAs with bearish DMA & MACD crossovers.

The current price remained below 7DMA despite today’s rallies, while both leading oscillators signal bearish momentum and lagging indicators signify the bearish trend clarity.

Well, let’s not isolate this analysis, to substantiate this bearish stance, both leading oscillators (RSI and stochastic indicators) converge downwards constantly to the ongoing price dips that signal the intensified momentum and strength the prevailing bearish sentiments.

Consequently, the above-mentioned bearish patterns have more imminent to counter the ongoing rallies at any time.

Please be extra keen on last six months’ price behavior, although the intermediary bulls have managed to spike above but remained below 38.2% Fibonacci levels.

For now, the stiff resistances are seen at 1.2791 levels, observe sharp rallies as the pair fails to touch these levels, this event has been happening twice or thrice today.

Both leading oscillators signal overbought pressures on weekly terms.

Sharp shooting star and hanging man patterns have occurred on monthly plotting as well.

Contemplating above technical rationale, at spot reference: 1.2778 levels, it is wise to snap deceptive rallies to deploy tunnel spread binary options strategy with upper strikes at 1.2790 and lower strikes at 1.2750.

Alternatively, go short in futures contracts of mid-month tenors with a view to mitigating downside risks.

Currency Strength Index: FxWirePro's hourly USD spot index is displaying shy above 87 levels (which is bullish), and CAD at 120 (bullish) while articulating (at 10:50 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: