Technical watch:

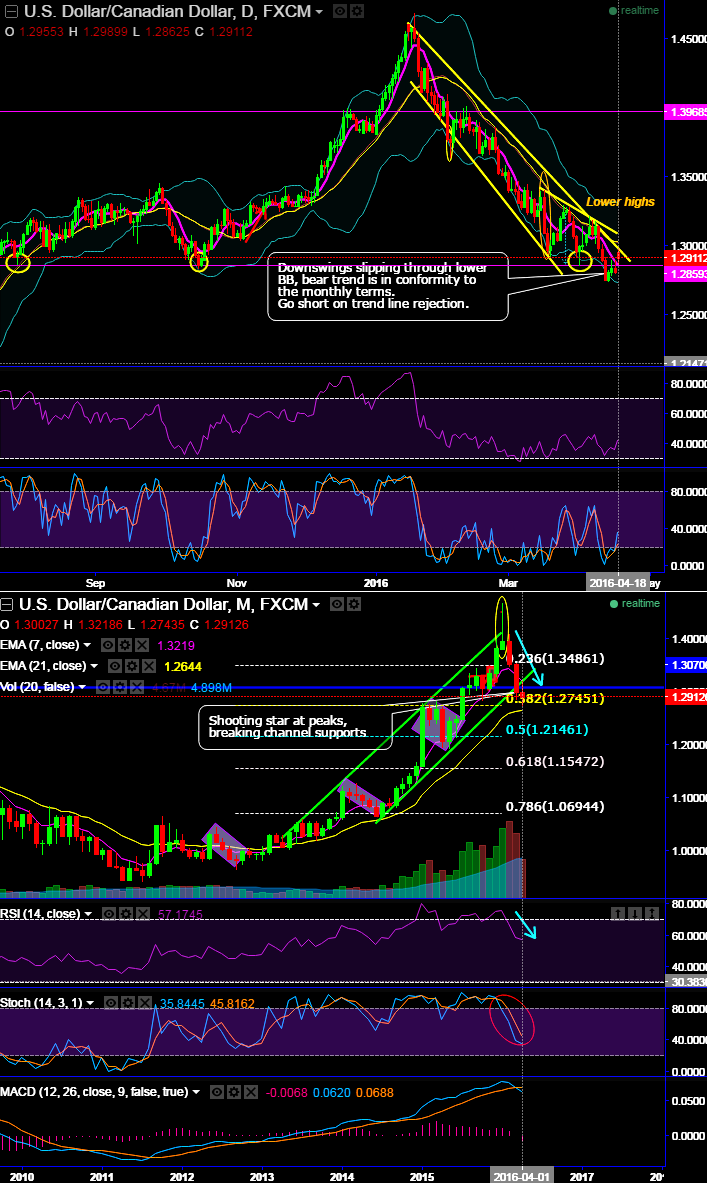

USDCAD bounces were restrained at trend line resistance at 1.2989 levels.

From last four days, the pair bounced from the lows of 1.2743 levels to 1.2989, that’s where it tested resistance at that level and unable to hold onto and collapsed as a result of more bearish pressures.

We uphold CAD’s strength as it still holding 8 and half months lows even though the existing rallies were considered.

RSI (14) could be deceptive if you interpret the current upward convergence as a bullish reversal as there is absolutely no confirmation from lagging indicators.

But instead, on the contrary the indicator evidences downward convergence to the price dips on monthly charts to signal more strength in bear rallies.

Same is the interpretation for another leading indicator (slow stochastic), so, we believe selling momentum may resume at any given time.

The current prices have remained well below 21DMA with bearish crossover.

On monthly plotting, we think the shooting star occurrence at peaks have still more bearish potential.

Last month it has broken below an important support at 1.3070 levels and channle support as well that signals more weakness and retest of next support at 1.2745 (38.2% Fibo retracement from peaks of shooting star) is likely event for now.

Trade tips:

We recommend on pure speculation basis buying one touch binary puts in order to extract leverage on extended profitability. By employing At-The-Money binary delta puts one can multiply returns by twice, thrice or even pour returns exponentially. But do remember these are exclusively for speculative basis.

The prime merits of such one touch option are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch USDCAD options are constant time and barrier levels. Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times.