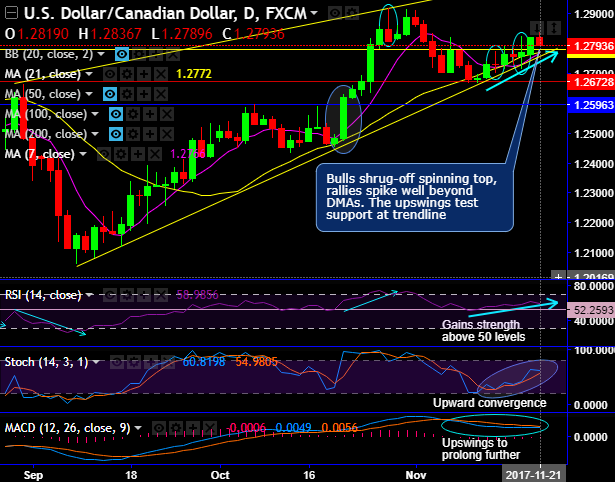

Chart and candlestick pattern formed- Rising channel on dailies and hammer on monthly plotting.

Please be noted that both bullish patterns have occurred and they have shown their bullish effects so far.

Hammer pattern candlestick has appeared exactly at 50% Fibonacci retracements, ever since then the steep spikes are observed but for now, the upswings are restrained below 21-EMAs.

Major supports are observed at 1.2779 and 1.2672 levels, and bulls have managed to break out these levels decisively.

It is now attempting creep up but with the minor hiccups, expect more rallies as both the leading oscillators have been constantly converging upwards to signal strength in prevailing rallies.

Any convincing sustenance above will drag the pair to next level upto 1.2820 that’s where the near term resistance is seen and any break above will take the pair till 1.2915. Minor bearishness only below 1.2772 (i.e. 21DMA).

Trade tips:

Contemplating above technical rationale, it is wise to buy boundary binaries options strategies with upper strikes at 1.2820 and lower strikes at 1.2779, the above strategy is deployed for limited yields but the certain ones as long as spot FX remains between above strikes on or before expiration.

Alternatively, one can buy futures contracts of mid-month tenors that is likely to encompass significant data events such as OPEC meeting, quarterly US GDP flashes, BoC monetary policy and Fed’s rate hikes in December.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -2 levels (which is neutral), while hourly CAD spot index was at shy above -39 (bearish) while articulating (at 11:48 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: