We cannot appreciate why CAD has been appreciating against USD as Bank of Canada’s has decided to maintain status quo in its monetary policy, overnight rates are kept unchanged at 0.50% which is in line with forecasts.

CAD is unable to benefit from a rising oil price to the extent it suffers when the oil price falls. One way or the other there is not a lot pointing towards a notably stronger CAD short term.

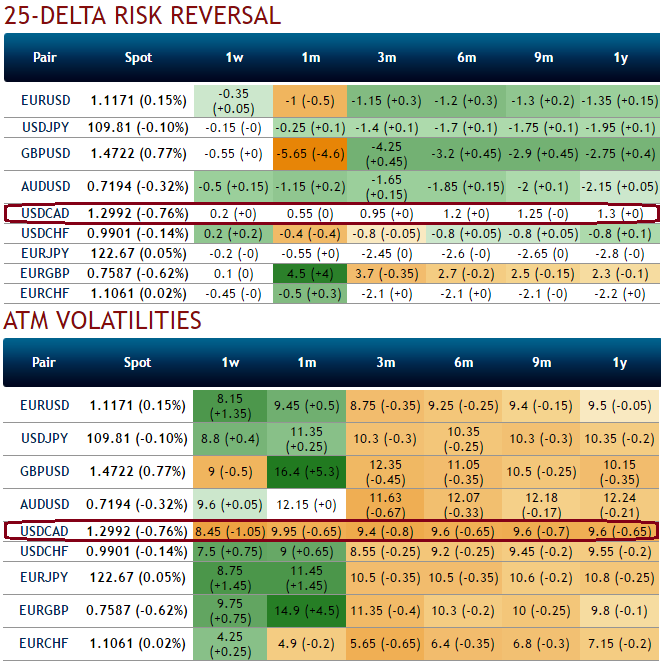

You get to see lot more insights from implied volatility and risk reversals of USDCAD.

OTC FX of this pair has been bullish neutral for 1m to 6m expiries, reducing considerably among G7 currency segment contemplating neutral risk reversal bullish signals which are negligible.

During such tepid OTC market situation where IVs have been stubborn to rise, the long put ladder strategy is suitable that fetches a limited certain returns associated with unlimited risk as it proportionately employs more shorts in the spread because the underlying FX pair will experience little volatility in the near term (refer IV and risk reversal table). Such risk can also be mitigated by choosing narrow expiries.

Ideally, to execute this strategy, the options trader purchases an (1%) in-the-money delta put, short an at-the-money put and short another (1%) out-of-the-money put of the same expiration date.

At spot ref: 1.2913, go long in 2M USD/CAD put ladder (strikes 1.3150/1.2915/1.2760).

Indicative offer: Reduces cost about little more than 50% vs prem for ITM strike only.

Our put ladder is built as a standard put spread with tight strikes set at 1.3150/1.2915 financed by an OTM put with a strike at 1.2760.

Leaving only 140-150 pips between the former two strikes allows the profile to quickly reach the maximal possible leverage.

Unlike an usual put spread ratio, the maximal return is not reached on a given strike but over a wide region. It maximises the profitability of the trade via increased odds that the spot will trade in this region.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise