Please be noted that the price behavior of USDCAD in major uptrend has formed rising wedge pattern which is bullish in nature.

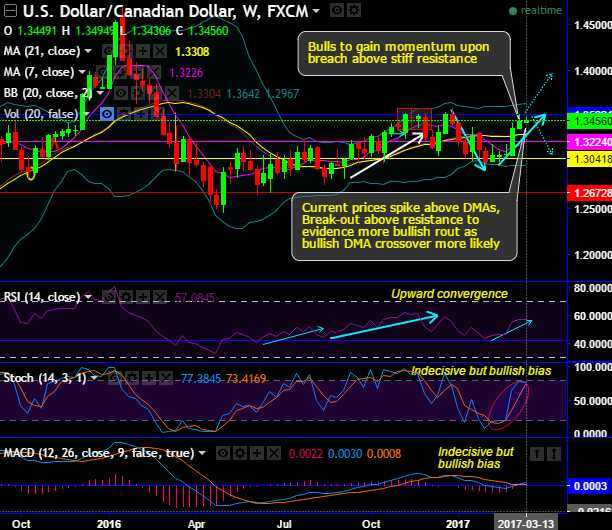

Bulls have taken strong support at 1.30 levels, subsequently, the upswings have spiked above DMAs after breaking stiff resistances at 1.3224 levels. Now heading towards one more resistance at 1.3522 is seen where long legged doji and hanging man are occurred at 1.3496 and 1.3513 levels respectively.

For now, the breach above these levels exposes more upside potential due to more bullish momentum offered by leading oscillators.

On a broader perspective, the bulls are forming handle pattern adjoining to previous saucer pattern in the major trend, the current prices have also spiked above (refer monthly charts).

To substantiate this bullish stance, rising volumes are in sync with the rising prices.

Both leading oscillators signal buying interests, as RSI (14) evidences a bullish convergence with the rising prices after testing support at around 42 levels multiple times (see dailies), currently trending upwards at above 57 levels, so we believe there has been buying sentiments atleast in short run.

While, stochastic has been quite indecisive to signal momentum in this buying sentiment as they reached overbought zone but remain slightly bullish bias.

On the flip side, in the recent past back-to-back long legged doji patterns were occurred at the current level and have shown their bearish effects on monthly patterns but for now, bulls resuming rallies are on the verge of extending handle pattern to the previous saucer pattern (see monthly charts).

Hence, one can initiate longs in futures contracts with near month expiries in this bullish environment ahead of Federal Reserve interest rate hiking decision which is due today during US session.