Since it stepped up into a higher range in July/August, EUR/CHF has been stuck trading around 1.07/1.10.

That still leaves USD/CHF determined by EUR/USD. After the ECB eased by less than expected in early December, the SNB also held off from easing.

But for now ECB surprised in rate decision by reducing its benchmark interest rate and cut its deposit rate into negative territory, in order to address economic slowdown and boost up inflation in the euro region (reduced interest rate from 0.05% to 0.0% while forecasts were remain unchanged, while deposit rates were also reduced by 10 bps to keep it at -0.4 in line with forecasts).

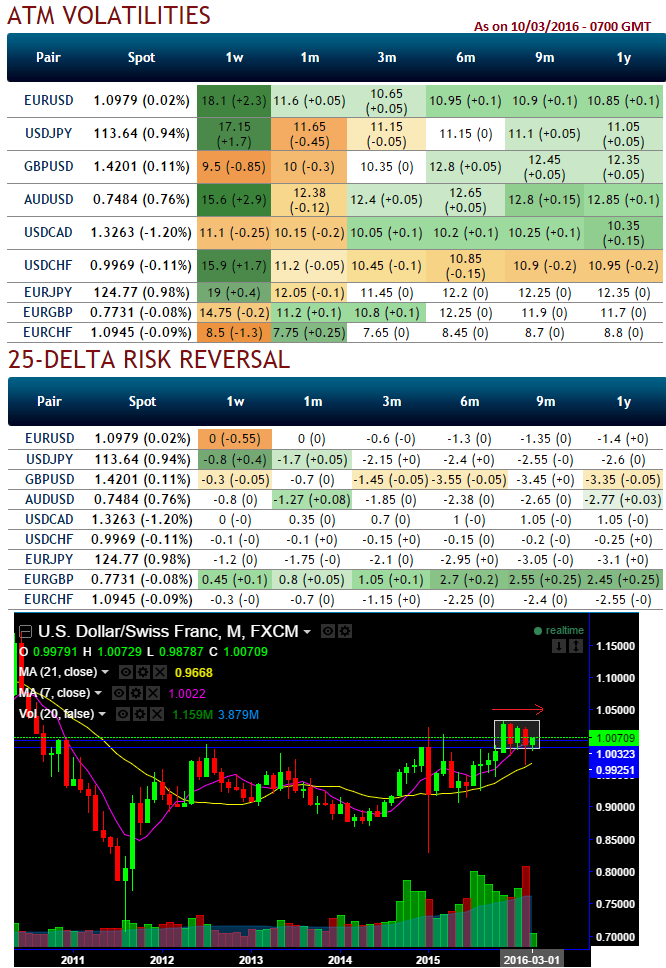

In turn, EURUSD and USDCHF Fx option markets are overreacting, as you can observe from the nutshell evidencing IVs and risk reversals, OTC options of both pairs of 1W expiries are hitting almost 18 and 16% respectively during this monetary policy seasons.

But steeping down at 11.2% for 1M and 10.45% for 3M tenors in case of USDCHF.

Historically, even though USDCHF shows significant volatility but this hasn't evidenced any clear trend on either direction, moving in sideways from last couple of months(observe technical chart).

Thus, smart approach USDCHF is that to deal with this higher implied volatility times and shrinkage, we eye on collecting credits or short for premiums, and hope for a contraction in volatility which OTC market has already signalling.

On speculative basis short strangles are the best suitable in prevailing condition of USDCHF, hence, we recommend shorting 1W (1%) OTM puts as well as 1W (1.5%) deep OTM calls for a net credit.

The strategy not only gives you the advantage of an anticipated volatility crush, but also give us some room to be wrong because we may short premium narrowing strikes while in greed of collecting more credit than when IV is low.

Maximum returns are achievable when USDCHF spot price remains between short strikes on expiration date. Both call and put options expire worthless and the strategy fetches you the certain yields in the form of entire initial credit taken.

FxWirePro: USD/CHF IVs no exception from rising ahead of SNB's policy season, trend narrowing - short HY IVs via OTM strangles

Thursday, March 10, 2016 1:23 PM UTC

Editor's Picks

- Market Data

Most Popular

9