The SNB stunned markets earlier this year after it removed the three-year old cap of 1.20 Swiss francs per euro.

Jordan said the decision to drop the cap in January was not a "panic reaction," at the time and was a "well thought-out decision." He added that he expected the value of the Swiss franc to ease back to "more sustainable levels".

In long term, the USDCHF has uptrend sentiments though, we don't expect mighty bounces as it is likely to struggle between 0.9930 to 0.9800 range in short terms.

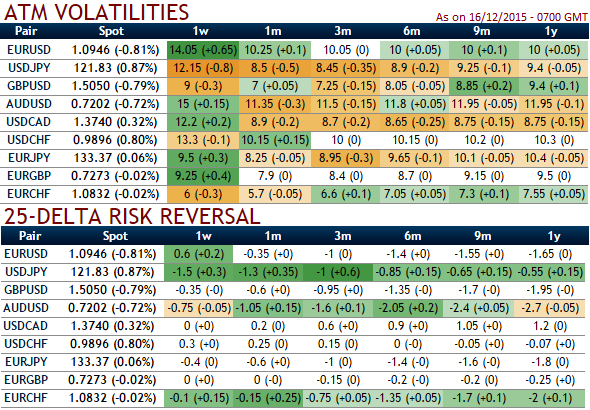

Considering the higher side of IVs ahead of Fed season (1w contracts at 13.3%) but the gradual decrease in implied volatility (projected a gradual decrease in 1m-3m ATM contracts at around 10%) and neutral delta risk reversal to dent bullish sentiments.

The pair is likely to move either in sideways or slightly bullish and it is projected vols to rise for contracts with 1m or 3m expiries, while delta risk reversal eing neutral, this would mean that there is much speculation in option markets in short run and uptrend in long run.

It means that Swiss foreign trades having their currency payables should be hedged so as to rest themselves assured with FX exposures.

When we had to study and compare this fluctuation of volatility and its comparison with risk reversal we tend to increase upper limits in the range determine for this pair as a result of increase in the IV.

So here goes the strategy this way, we advise shorting OTM call and buy deep OTM calls, simultaneously short ITM call and deep ITM call options with identical maturities.

The highest loss for this option strategy is equal to the initial debit taken when entering the trade.

It happens when the underlying exchange rate on expiration date is at or below the lowest strike price and also occurs when the pair is at or above the highest strike price of all the options involved.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?