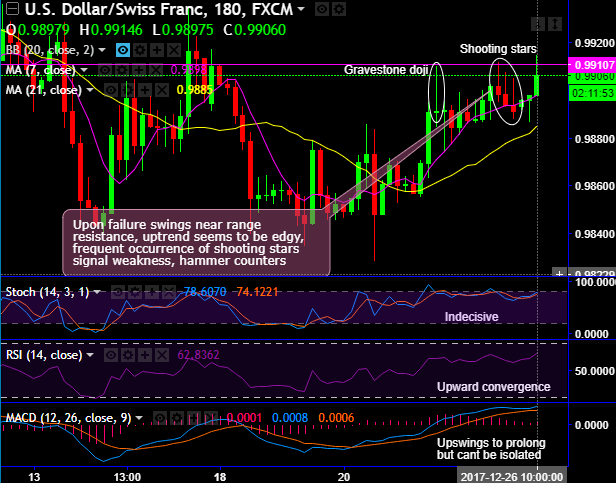

USDCHF forms back-to-back shooting star patterns on intraday plotting to hamper the bullish momentum, while non-directional phase in major trend remains intact but inching higher through rising wedge baseline.

Spot out shooting stars at 0.9898, 0.9893 and again at 0.9891 levels in the recent past. As a result, the prices slide below 7DMAs.

Hence, we see USDCHF’s major resistance levels at these levels 0.9911-0.9990 levels.

Subsequently, Hammer pattern occurs to counter the price dips. As a result, the current prices are shot up restrained again at the above-stated resistance levels.

Notably, gravestone doji pops at around the same resistance levels hampering the previous buying momentum but on the contrary, more rallies seem to be on the cards upon the test of strong support of wedge baseline at 0.9753 levels.

Although the leading oscillators have been slightly indecisive to signal buying sentiments, bulls’ favor.

RSI has historically, shown the faded strength at 60-65 levels (refer monthly charts) but showing strength 62s on 3H charts. While stochastic curves are approaching 80s (which is bearish territory) but no convincing signals on either side.

For now, the pair is attempting to breach above stated significant resistance levels but failed to do so, we uphold the above mentioned bearish patterns.

Contemplating above both bearish/bullish sentiments and the major trend in consideration, on trading perspective, it is advisable to buy boundary binaries using upper strikes at 0.9915 and lower strikes at 0.9880 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX remains within these strikes on or before the binary expiry duration.

While the FxWirePro currency strength index for the USD has been bearish by flashing a shy above 36, while CHF has also been highly bearish by flashing -136 while articulating (at 10:52 GMT).

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: