Glance over OTC:

1M lacklustre IVs uphold the significance of USDCHF long put butterfly spread:

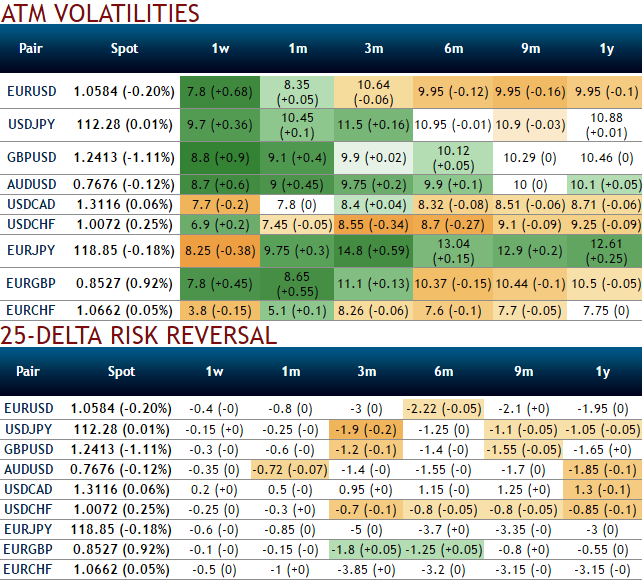

ATM implied volatilities are not rising considerably, still below 9% (to be precise 7.45% for 1m expiries and 8.55% for 3M expiries). Well, if you have short positions in option and IVs are shrinking away, bingo..!! It's a conducive environment for option writers.

Hence, we reckon the long put butterfly spread is best suitable in such scenarios on speculative grounds that carry the limited returns and the limited risk.

Three distinctive strikes are involved in this spread and it is constructed by buying one lower striking put, writing two at-the-money puts and buying another higher striking put for a net debit.

The execution: Buy (1%) 1m in the money put option, short 2 lots of 2w at the money put options, simultaneously; buy one more (1%) 1m out of the money put option.

The maximum return for the long put butterfly is achievable when the GBPNZD spot remains unchanged as stated in above range at expiration. At this price, only the highest striking put expires in the money.

This strategy is typically executed when the options trader thinks that the underlying spot FX would not spike or drop much dramatically on expiration and for the cost advantage.

While, risk reversals have also been in sync with IVs and spot FX movements, these numbers also have been bearish neutral for next 1 month but mounting hedging in 3m tenors.

We stay short EURCHF in cash and add downside in USDCHF through a diagonal debit put spread.

Our choice of a put spread is motivated by: 1) the French election calendar should prevent USD/Europe from running away ahead of the second-round presidential runoff on May 7 and the Assembly elections on June 11 and 18, and 2) digitals are reasonably priced for downside in USDCHF (refer above chart). The digital profile can be replicated with a vanilla spread.

Buy a 1m3m USDCHF debit put spread (with strikes of 1.0225 – 0.9515) (at spot reference 1.0050).

We encourage shorts EURCHF in spot FX as IVs for this pair is conducive for optionality, so, go short in debit spreads.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One