Shorting vega and downside has good risk-reward Vega volatility structurally expensive.

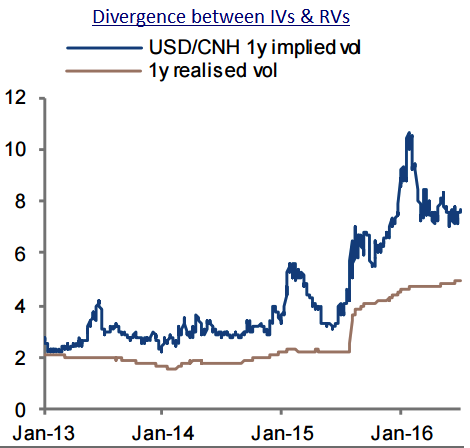

USD/CNH 1y implied volatility consistently trades at a significant premium above the realised volatility (see above graph).

The option investors have not been rewarded until now by sufficiently large spot deviations over time given this market pricing. This suggests favouring short volatility structures.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. A seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Vanilla calls or call spreads are too expensive when considering the probability-weighted terminal value of CNH a year from now.

Under the premise that USD/CNH only retraces a modest portion of the recent gains (similar to past experience when after an up move USD/CNH did not revisit the lows) and that there are no strong arguments for sustained appreciation on fundamental grounds, selling downside optionality can cheapen the cost of the call spread quite significantly.

With the help of the divergence between IVs and RVs shown in the above diagram, you can trade the IV value by monitoring an IV chart for a specific underlying market for a certain time period and determine the IV range. The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive. This information can be used when deciding which options to buy or sell.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close