USD/JPY chart - Trading View

USD/JPY is extending previous session's weakness, trades 0.25% lower on the day at 113.53 at around 06:40 GMT.

The Japanese yen edged higher after the Bank of Japan’s (BOJ) monetary policy decision and economic forecasts came as per the market expectations.

The BOJ kept monetary policy settings steady on Thursday, maintained cash rate at -0.1% and its 10-year government bond yield target around 0%.

The central bank also cut its consumer inflation forecast for the year ending in March 2022 to 0% from 0.6%.

BoJ's decision reinforced market bets that the central bank will lag other central banks in dialling back crisis-mode policies.

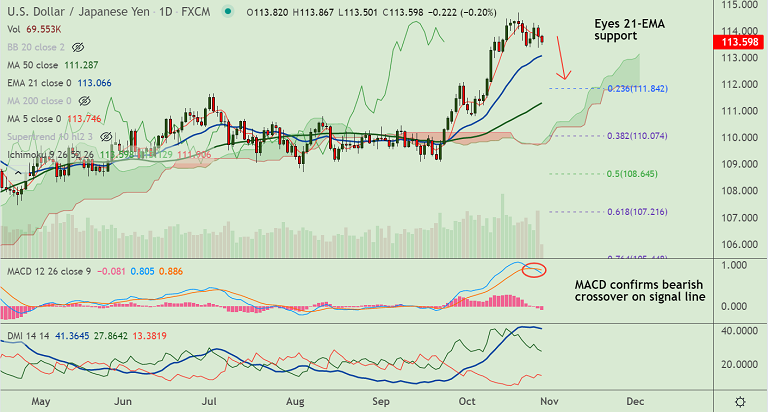

Technical analysis for the pair suggests scope for further downside. Price action is below 200H MA, MACD confirms bearish crossover on signal line, Chikou span is biased lower.

Major Support Levels: 113.06 (21-EMA), 112.91 (5-week MA), 111.84 (23.6% Fib)

Major Resistance Levels: 113.75 (5-DMA), 114.01 (200H MA), 114.69 (Yearly high)

Summary: USD/JPY trades with a major bullish bias, but overbought conditions are likely to add some downside pressure. Correction is likely to be shallow. Dip till 21-EMA at 113.07 likely.