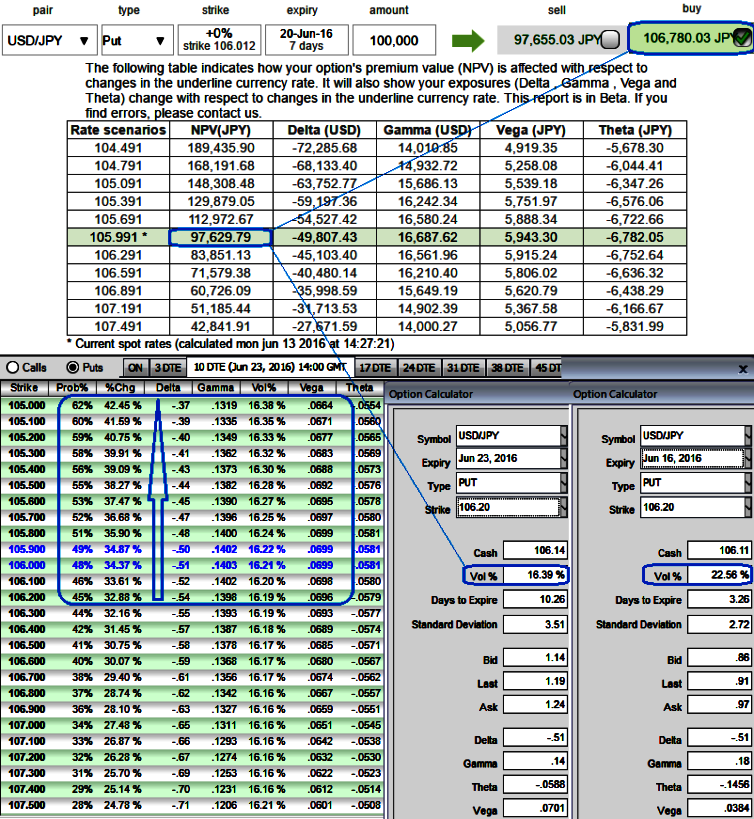

The ATM IVs of USDJPY of 1w expiries are trading at 15.65%, while ATM premiums are trading 9.37% more than NPV.

Since the Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows, FX traders need to be cautious while choosing the fairly valued options.

The components of option value include intrinsic value, its time value and the implied volatility of the underlying asset.

So contemplating the difference in the option value and its IVs of the same tenor, we think put premiums are fairly priced in.

Well, being right or wrong doesn’t matter as long as your portfolio is able to generate positive cash flows as per George Soras.

How much more money you made when you are right and how much less you lost when you are wrong is all that matters.

There exists the role of shrewdness in our hedging or speculative strategies, which instruments to use (futures, options, forwards or what not). To move a step ahead, if it is to be selected FX options then which strikes are to be selected.

If you observe the sensitivity table, we tend to choose the OTM strikes of 10 Days to expiry so as to spot out the more productive and to give a leveraging touch to FX portfolios as these put instruments of OTM strikes evidence the healthy gamma and higher vols with higher probability numbers. This would mean that the more likelihood of expiring in the money on expiry.

On the other hand, while hedging for downside risks if you’ve chosen OTM strikes then you would be on competitive edge as these contracts would likely benefit in two ways, one that is to reduce hedging cost as OTM contracts would be cheaper than ATM and secondly, more chances of tackling negative risk reversals as per the above Greeks computations.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge