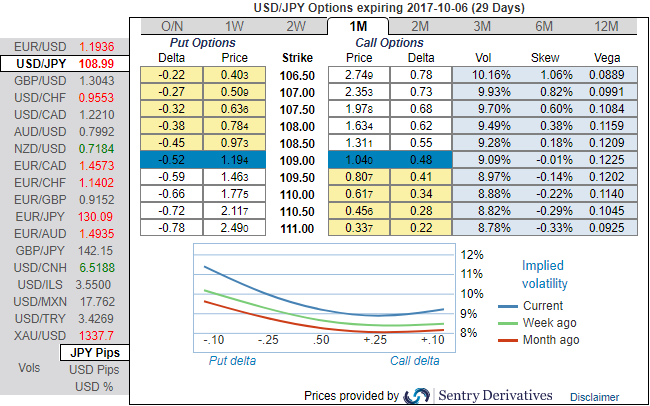

We came across the implied volatility of ATM contracts of USDJPY across all tenors are shrinking lower, just shy above 9.5%, while risk reversals have been bearish neutral.

The rationale is that any abrupt upswings should be optimally utilized in order to arrest potential downswings to the maximum extent regardless of trading or hedging grounds, so to participate in that downtrend, weights in the portfolio should be increased with more number of put contracts but consciously while choosing the right instruments.

Implied volatility is an important factor to consider in options trading because the prices of options are directly affected by it. A spot rate with a higher volatility will have either had large price swings or is expected to, and options based on a security with a high volatility will typically be more expensive.

Please be noted that the IV skewness is very useful in determining this decision, here in case of USDJPY, one could easily make out positively skewed IVs are signifying the importance of OTM puts but not deep out of the money puts (1m skews are suggesting strikes maximum upto 106.50). And also be noted that this bearish sentiment is also substantiated by the mounting negative risk reversals that again indicates further bearish risks.

Well, this is intuitive due to the higher likelihood of the market 'swinging' in your favor. If IV increases and you are holding an option, this is good. In contrast, if it goes in an adverse direction, then one should raise a cause of concern for his options strategy.

A smart approach to tackle this obstacle and potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. The simplest way to do this is to buy at the money contracts or OTM strikes but certainly not deep OTM strikes.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -50 (which is bearish), while hourly JPY spot index was at 10 (neutral) at 07:26 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand