Negligible interim rallies stuck in the tight range, while momentum oscillators’ signal selling pressures and the major trend has again resumed bearish sentiments (refer both daily and monthly charts).

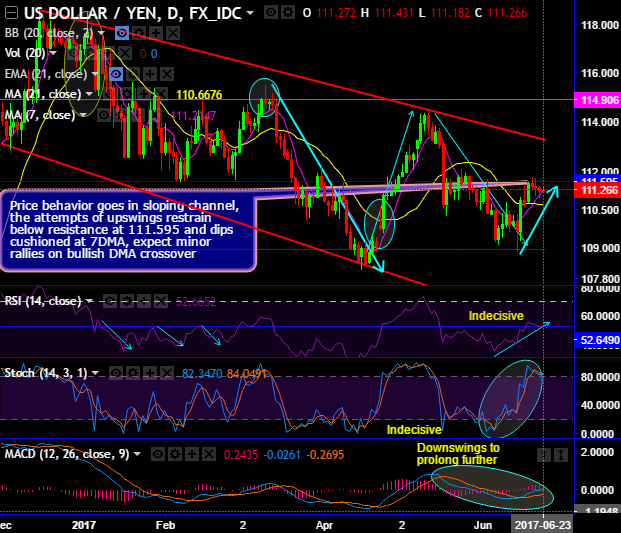

The price behavior goes in sloping channel, the attempts of upswings restrain below resistance at 111.595 and dips cushioned at 7DMA, expect minor rallies on bullish DMA crossover.

Since the failure swings below stiff resistance at 111.595 levels and losing strength in rallies, don't expect sharp rallies as the trend for the day seems to be non-directional.

After bearish engulfing, shooting stars & Gravestone doji, bears managed to break below major supports at 112.575 & EMAs, No traces of bullish indication as both leading & lagging oscillators indicate bearish momentum.

RSI on both daily and monthly terms signals strength in selling interests as it converges to the downswings, while Stochastic has been indecisive on dailies but signals the intensified momentum in selling sentiments on monthly terms.

While the FxWirePro currency strength index for the dollar amid CPI data has been extremely weaker despite relinquishing its gain yesterday (-116 highly bearish), while JPY has been slightly weaker by flashing -46 for the day sensing some sort of gaining traction ahead of US CPI.

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

Trading tips:

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads for the day which are binary versions of the debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 111.275 and lower strikes at 110.667 levels.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate