- USD/JPY has broken past the psychological 115 handle and is currently trading at 115.21.

- Focus now on NFP data due later in the U.S. session for further direction.

- Markets are pricing in a better US NFP report, especially after surprisingly positive ADP jobs data.

- A strong NFP reading will likely cement a Fed rate hike as early as next week.

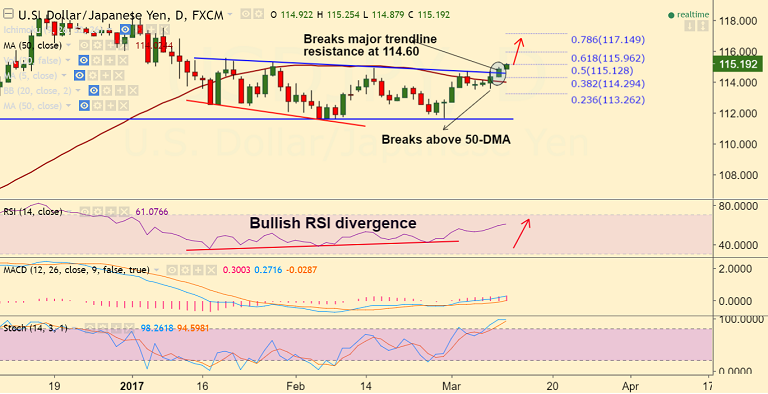

- Technicals also support gains in the pair, slight bullish divergence on RSI seen.

- The pair has broken major trendline resistance at 114.60, is currently hovering around 50% Fib retrace of 118.662 to 111.594 fall.

- On the flipside immediate strong support lies at 114 (50-DMA), bullish invalidation on break below.

Support levels - 115, 114.55 (trendline), 114 (50-DMA), 113.65 (20-DMA)

Resistance levels - 115.37 (Jan 27 high), 115.62 (Jan 19 high), 115.96 (61.8% Fib of 118.662 to 111.594 fall)

TIME TREND INDEX OB/OS INDEX

1H Bullish Overbought

4H Bullish Overbought

1D Bullish Neutral

1W Bullish Neutral

Call update: Our previous call (http://www.econotimes.com/FxWirePro-USD-JPY-struggles-at-major-trendline-resistance-at-11460-upside-only-on-break-above-581513) is progressing well.

Recommendation: Hold for targets.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 31.1798 (Neutral), while Hourly JPY Spot Index was at -105.42 (Highly bearish) at 0430 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.