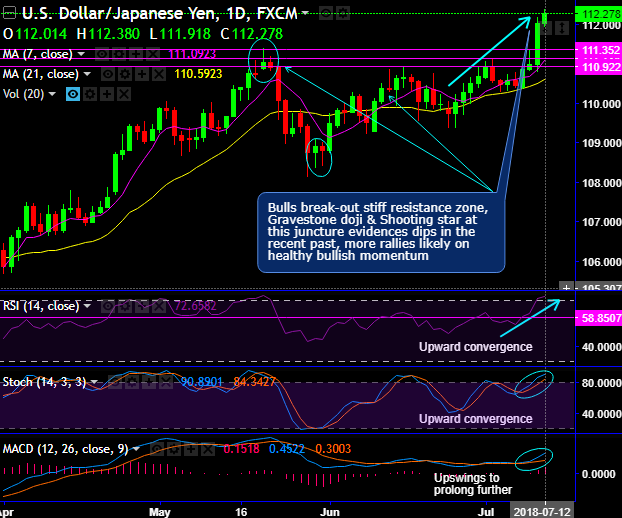

- USDJPY has broken out a stiff resistance zone of 110.922 – 111.352 levels decisively on Wednesday's trade as markets nudge trade wars tormentor.

- The pair is currently extending its gains to 6-months highs, currently trades 0.20% higher from yesterday’s close at 112.235 while articulating.

- Both leading oscillators are signalling healthy bullish momentum on daily charts. We could foresee scope for further upside traction. While trend indicators are also substantiating the similar bullish swings to prolong further.

- On major trend, bulls are retracing from the March 2018 bottom of 104.629 levels to the November 2017 highs which if successful will foresee further upside upto next 78.6% Fibonacci levels (refer weekly plotting). Price action on this timeframe has bounced back into the long lasting range bounded trend.

- On the flipside, the major trend has been bearish, but 7-EMA likely to act as the major support at 110.6024 levels. We see bullish invalidation on retrace below.

- While Yen seems to be losing its safe-haven sentiments as markets seem to trust Trump's move by imposing tariffs on Chinese goods.

Key Support and Resistance Levels: 110.922 - 111.352 areas are regarded as strong support zones, and 112.613 (78.6% Fibonacci retracements for November 2017 highs).

Trade tips: On every dip, it is wise to initiate longs in one touch calls for the TP: 112.55/113 levels with strict SL: 111.80 areas.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 45 (which is bullish), while Hourly JPY Spot Index was at -97 (bearish) at 05:32 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex