The front end in the US has finally started to move. After more hawkish minutes, a stronger US inflation print, and a raft of Fed speakers warning of the possibility of up to two hikes this year, June and July are becoming more actively priced.

Be cautious on: Upcoming speeches from Fed Chair Yellen (early June) and Vice Chair Fischer (tonight) will be critical to market expectations of the Fed. The PEFO will be released on Friday with the most up to date Australian economic forecasts.

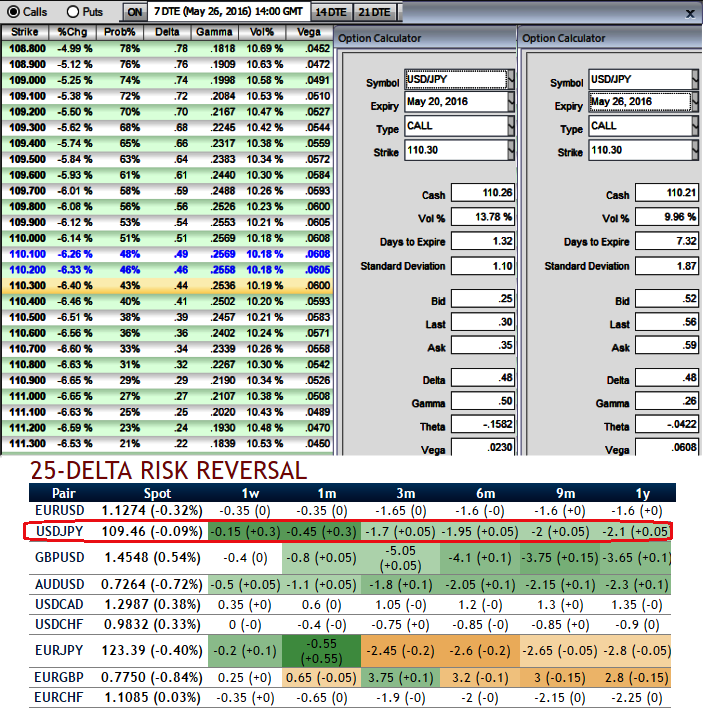

The current IVs of ATM contracts of USDJPY are at 13.78% but likely to reduce below 10% (precisely 9.96%)in next 1 week’s time, we see positive tickers on delta risk reversals, even then the net hedging positions in long run would suggest that the bearish risks in this pair.

USDJPY’s major trend has been downtrend, but last couple days’ bull swings are evidenced as it bounced above DMA curves, we foresee these upswings may extend upto 111.063 in near future.

Hence, it’s reckoned that it is wise to use these upswings for shorts in hedging strategy capitalizing on reducing IVs, The rallies would be used as the best entry levels for fresh shorts build ups for southward targets when IV shrinks.

Hence, considering implied volatility, OTC and underlying spot FX market sentiments we think medium term downside risks are still on the cards.

So, if you expect that USDJPY spikes in short run but tumble again towards recent lows, then the upswings offered by bulls is the right times for shorts in puts with shallow ITM strikes and shorter expiries.

Well, then here comes the right strategy to tackle these type of swings, “bull put spread” at net credits, buy next month (1%) Out of the money -0.5 delta put option. Simultaneously, short 1W (1%) in the money put with positive theta.

Notice in this instance that the put we bought is out of the money and the put we sold is in the money with an anticipation of USDJPY could rise or remain unchanged, and there onwards any abrupt fall would be taken care by longs in OTM put and your active longs in spot FX would be protected.

Maximum profit: The initial credit received for this trade, less commission costs.

The maximum risk is the difference between the two strike prices, minus the credit you received.

Most probable scenario would be that it may show maximum jump upto minor resistance at 111.063 levels and then slip back again.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge