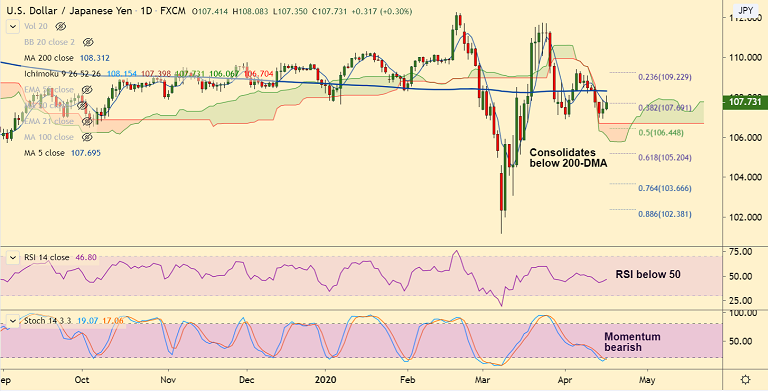

USD/JPY chart - Trading View

USD/JPY was trading 0.35% higher on the day at 107.78 at around 08:20 GMT.

The pair has edged lower from session highs at 108.08, finds stiff resistance at 21-EMA at 108.18.

The major is extending gains for the second straight session on broad-based US dollar demand.

Persistent worries over the economic fallout from the coronavirus pandemic together with Wednesday's dismal US economic data likely to cap upside.

Technical indicators do not provide a clear directional bias. Retrace above 200-DMA could see upside resumption.

Focus on U.S. weekly jobless claims data due later in the U.S. session, which might influence the USD price dynamics.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise