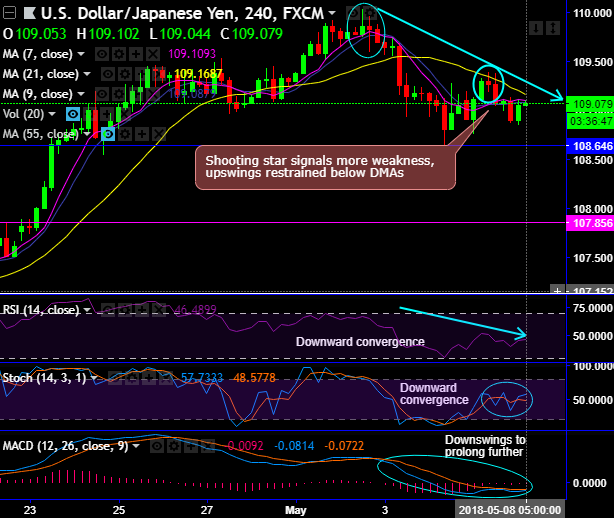

USDJPY major stiff resistance is observed at 109.1096 (i.e. 21SMA levels).

Shooting star occurs at 109.862 and 109.261 levels to signal weakness, evidence considerable price slumps (refer 4H chart).

For now, the upswings are restrained below DMAs.

On the flip side, the strong support is seen at 108.646 levels.

Ever since USDJPY forms shooting star and hanging man patterns at peaks of rallies, prices have gone below 21DMAs, signaling more weakness in the days to come.

Observe failure swings at the same levels, shooting star in the recent past has occurred and hampered previous bullish sentiments.

Both RSI & stochastic curves are indecisive but converging slightly downwards on intraday terms to indicate healthy selling momentum.

While the trend indicators (7&21 SMA and MACD) have also been indecisive but showing little bearish bias.

The major trend is still stuck between 115.441 and 107.321 levels (refer weekly plotting), the trend on this timeframe shows failure swings exactly at 114.721 levels couple of times in the recent past.

Overall, although we see little upside traction in the near-term and the major downtrend seems to be intact.

Trading tips: Contemplating above technical rationale, we advocate buying tunnel spread binary options strategy with upper strikes at 109.1096 and lower strikes at 108.853, this strategy is likely to add magnifying effects to the yields as long as the underlying spot FX remains between these two strikes on expiration.

Alternatively, maintain short hedges by adding shorts in futures contracts of mid-month tenors with a view to arresting downside risks.

Currency Strength Index: FxWirePro's hourly USD spot index has shown 96 (which is bullish), while hourly JPY spot index was at 67 (bullish) while articulating at 05:40 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: