Japanese machinery orders have shown improved numbers MoM basis, a jump from 4.2% to 15% in February over the previous period.

This week's key data focus would be on BoJ, US Fed and Swiss monetary policies.

For today, Yen gained against dollar about 0.21% as USDJPY was unable to hold onto day highs at 114.006.

Rationale behind USDJPY pressures for downside risks:

Although the Fed will likely to remain on the sidelines on March 16th, the improving domestic backdrop supports our view that the Fed will continue on with its gradual tightening cycle in June.

We think current macro situations lead the fed to almost defer policy actions to June meeting, but manipulative statements on monetary policy outcome may keep USDJPY at stake.

On the other hand, we can very much empathize with this Yen against dollar to gain slightly at least in short run (let's say next 2 months or so) with an anticipation of Fed may continue to hold on its rate stance until Q2'16 considering global economic slowdown.

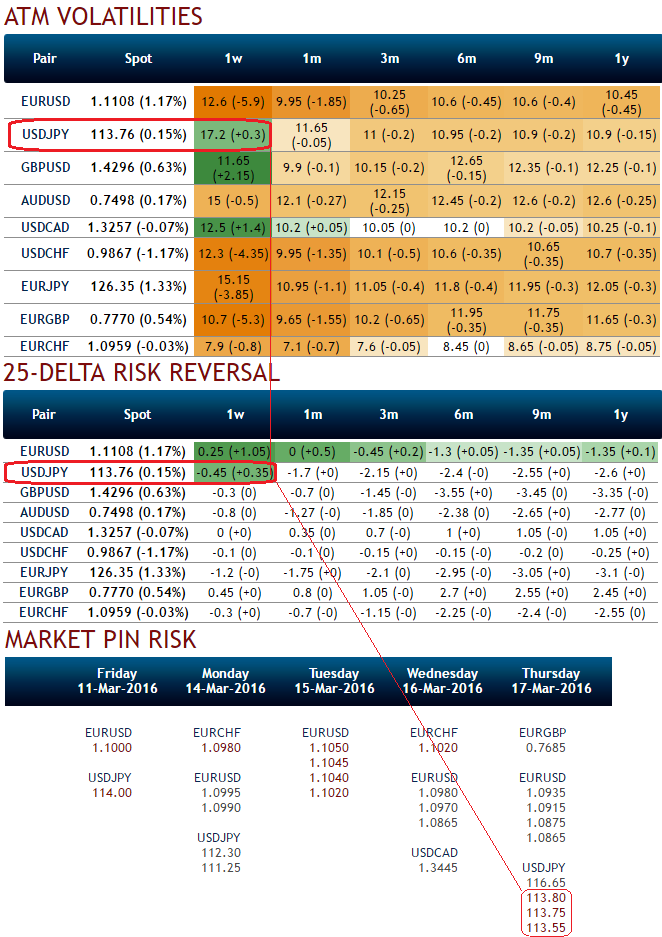

From delta risk reversal reasoning, the pair is still considered to be one of the weakest currency crosses among entire G20 currency space in long run but positive recoveries in risk reversal numbers, so we believe any short upswings are the best advantage for bears and may be utilized for shorts in hedging strategies so as to reduce the hedging costs. (Compare delta risk reversal with last week), as you can also observe from the market pin risk in FX option market, you see sizeable open interest for 113.800 or below strikes for one expiries which means more number of outstanding contracts upto those levels.

Most importantly, the pair is likely to perceive implied volatility close to 17% of 1W ATM contracts that would likely decrease to 11.65% with increase in negative risk reversals, thus we recommend deploying short put ladder spreads that contains proportionately less number of shorts and more longs which would take care of potential slumps on this pair and significantly higher volatility times.

So, short ITM put with shorter expiry since implied volatility is inching higher when risk reversals are lesser comparatively to 1W expiries which is good for option writers ahead of data season, since the signals for long term downtrend have just begun, so the strategy goes this way, go long in 2 lots of ATM and OTM put with longer expiry (per say 2M expiries) and simultaneously short 1W ITM puts with positive theta values.

FxWirePro: USD/JPY highest IVs among G20, sizeable OI at 113.80 for 1W contracts - deploy short put ladders for hedging

Monday, March 14, 2016 7:08 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022