After nine months of consolidation phase to prevent bears in the major trend is visible in monthly plotting. The major trend turns into consolidation phase again after last month’s bearish swings, the potential bullish EMA crossover is likely after bulls testing strong support at EMAs.

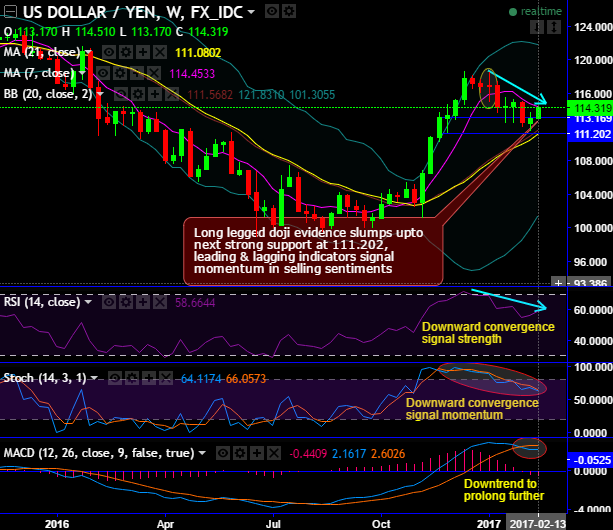

On the contrary, long legged doji on weekly terms evidences slumps up to next strong support at 111.202, both leading & lagging indicators signal momentum in selling sentiments.

USDJPY dropped vigorously from the highs of 118.608 levels to the recent lows of 111.595 levels, the bears in Yen are lined up especially after Fed’s minutes that includes gradual hiking hints.

The current prices on weekly have dipped below 7SMAs and remained well above EMAs on monthly terms.

Hence, for now, don't expect sharp rallies nor a steep slump as it is on the verge of bullish EMA crossover (7EMA crossing over 21EMA), and it is better to devise trading plans that favors both short-term bears as well as bulls in the consolidation phase.

Trading tips:

At this juncture, we see speculative opportunities in double touch binary options, this option trade is useful for intraday traders who believe the price of an underlying spot FX would undergo a large price movement, but who are unsure of the direction.

At spot ref: 114.319, a trader can use a double touch option with barriers at 114.541 and 113.978, thereby, this range is reasonable to speculate this pair on either side.

Some traders view this type of exotic option as being like a straddle position since the trader stands to benefit on a calculated price movement up or down in both scenarios.