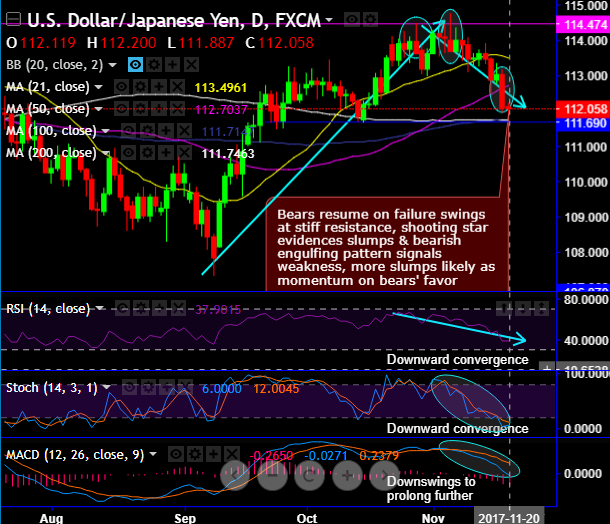

USDJPY pops up bearish engulfing pattern candle at 112.085 that signals more weakness in the days to come.

Earlier this month, back-to-back bearish patterns such as shooting star and hanging man patterns have occurred to repeat the history at stiff resistance of 114.474 levels,

While the major trend shows failure swings exactly at 23.6% Fibonacci levels from the highs of 125.280.

On the flip side, the pair, for now, testing support at 21-EMAs.

In this oscillation, the pair is on the verge of forming the triple top pattern with top 1 at 114.368, top2 at 114.495 and top3 at 114.737 levels and neckline at 107.293 levels, the triple top pattern which is bearish in nature is moving in sync with the indications of the leading oscillators (refer weekly plotting).

The bulls in previous upswings seem to have lost upside traction totally as the momentum has turned into bearish favor and signaling overbought pressures.

Momentum analysis: Stochastic curves on daily terms have entered into oversold territory but no traces of %k crossover so far, overbought pressures are boiling on weekly terms and RSI evidences bearish convergence on dailies that indicates strength in the downtrend, same has been the case on weekly terms.

Trend analysis: Lagging indicators (MACD, 7 & 21 EMAs) have been indicating indecisiveness while prices attempt to slide. The current prices are still below 7EMAs but testing support at 21EMA, any abrupt bullish sentiment for this month is not backed by momentum & trend indicators.

Trading tips: Contemplating above technical rationale, we advocate buying one touch binary puts, this strategy is likely to add magnifying effects to the yields as long as the underlying spot FX keeps dipping on expiration.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -10 (which is neutral), while hourly JPY spot index was at 34 (mildly bullish) while articulating at 06:19 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: