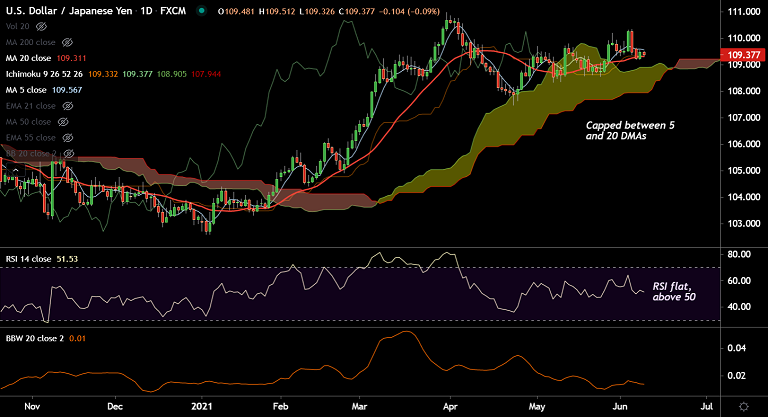

USD/JPY chart - Trading View

USD/JPY was trading 0.06% lower on the day at 109.41 at around 11:35 GMT, extends choppy trade around 21-EMA.

The US dollar remains on the defensive ahead of Thursday’s key CPI data. Traders refrain from placing any aggressive bets.

The US CPI report (due Thursday) will throw fresh cues on the Fed’s next monetary policy action amid rising inflationary risks.

The FOMC will be meeting on June 17. Any hints about taper will probably put upwards pressure on the dollar/yen pair.

Technical analysis shows major trend is bullish. Near-term bias has gone flat. The pair is holding support at 21-EMA.

Price action is consolidating above 200-week MA. Resumption of upside will see test of trendline resistance at 110.75 ahead of yearly highs at 110.96.