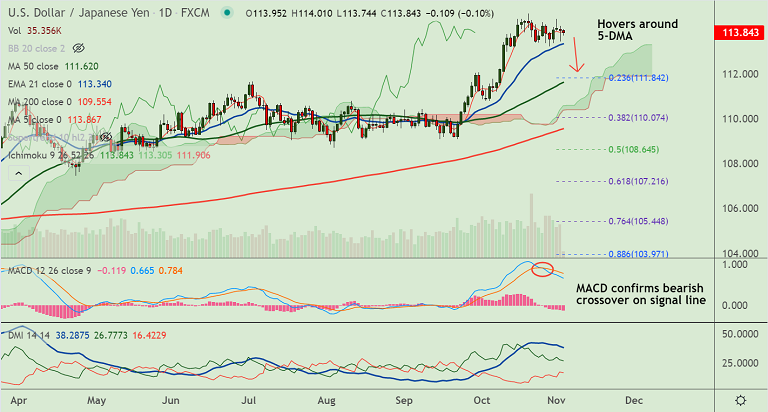

USD/JPY chart - Trading View

USD/JPY was trading 0.11% lower on the day at 113.82 at around 06:45 GMT, extends range trade ahead of the Fed policy meeting.

The Fed is expected to announce the tapering of its $120 billion-a-month asset purchase programme in its policy statement at 1800 GMT.

Investors expect the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Markets also await for clues around the timing of rate rises, after volatile moves in the bond market in anticipation of hikes as soon as next year.

Major trend for the pair is bullish. But the pair has been struggling at 114 handle from the past few weeks.

Overbought conditions on the weekly charts keep scope for pullbacks. On the flipside, breakout above 114 handle will fuel the next bull run.