- USD/JPY retraces from session lows at 110.45, trades 0.12% higher on the day at 110.75.

- Bank of Japan (BOJ) announced no changes to its monetary policy settings, holding rates at -10bps, while maintaining 10yr JGB yield target at 0.00%.

- The central bank cut assessment on inflation, signaling that policymakers will be in no hurry to dial back the stimulus.

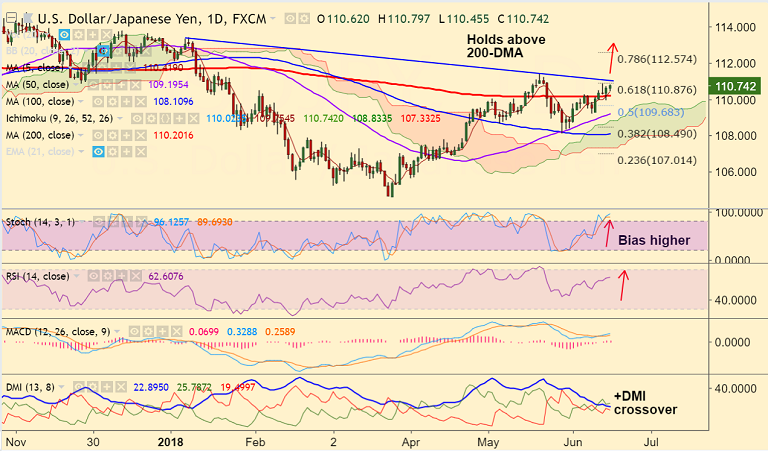

- The pair has largely ignored a gravestone doji formation on June 13th trade and has failed to close below strong support at 200-DMA.

- Technical indicators support bullish bias, breakout at 111 (major resistance) could propel the pair higher.

- Scope then for test of 78.6% Fib at 112.57. While close below 200-DMA could see some weakness.

Support levels - 110.42 (5-DMA), 110.20 (200-DMA), 110

Resistance levels - 110.87 (61.8% Fib), 111 (trendline), 111.39 (May 21 high)

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 58.8273 (Neutral), while Hourly JPY Spot Index was at -26.472 (Neutral) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.