- Yen largely ignored higher than expected PPI data earlier today.

- Japan’s January corporate goods price y/y increase to 0.5 % (forecast 0.0 %) vs previous -1.2 %

- Japan’s January corporate goods price m/m stays flat at 0.6 % (forecast 0.2 %) vs previous 0.6 %.

- BOJ increased purchase of superlong JGBs in Friday's operation.

- Trump’s latest talks of tax cuts in the coming weeks and BOJ’s bond buying announcement saw rally in USD/JPY.

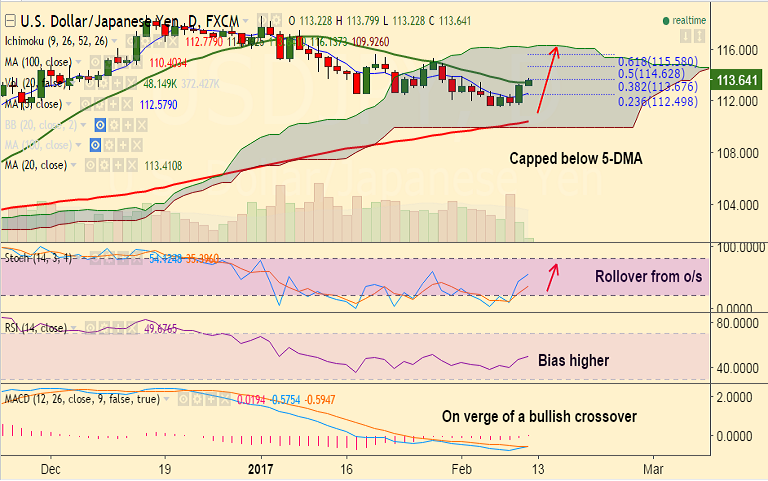

- But upside seen capped by 38.2% Fib retrace of 118.66 to 110.59 fall.

- Improved risk sentiment after the Chinese Jan trade data to weigh on the Yen.

- Focus now remains on the developments surrounding Trump and Japan PM Abe’s meeting scheduled later today in Washington.

- Technical studies are slightly bullish. We see scope for test of 50-DMA at 115.03.

- The pair has broken 20-DMA at 113.41 and is currently hovering around 38.2% Fib.

- Stochs have rolled over from oversold levels and RSI is biased higher.

Support levels - 113.41 (20-DMA), 113, 112.59 (5-DMA)

Resistance levels - 114 (psychological level), 114.62 (50% Fib), 115.03 (50-DMA)

TIME TREND INDEX OB/OS INDEX

1H Bullish Overbought

4H Bullish Neutral

1D Bullish Neutral

1W Bearish Neutral

Recommendation: Good to go lon on dips around 113.50/60, SL: 113, TP: 114/ 114.60/ 115

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -68.1476(Bearish), while Hourly JPY Spot Index was at 42.837 (Neutral) at 0340 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.