The major downtrend of USDJPY since October 2017 that has turned reverse from mid-March. The pair has been spiking higher from the last 5-weeks considerably from the lows of 104.629 to the current 108.245 levels.

Dear readers, before we move onto the core part of this article, just glance through below weblink where we advised 3 leg options strategy for hedging optimally.

Well, As USDJPY was well-anticipated spikes and has significantly risen from the lows of 104.629 levels to the recent highs of 108.245 levels amid the major downtrend, we’ve already advocated diagonal put ratio back spread about a fortnight ago.

For now, short leg (ITM shorts) of this strategy would have fetched attractive yields as the underlying spot FX has significantly spiked above, while long legs are yet to function having two months of expiry.

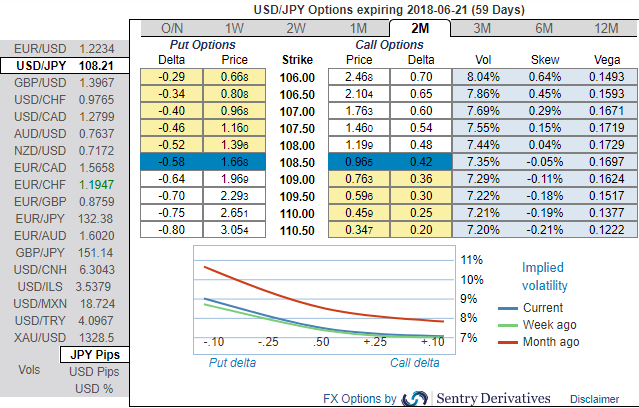

The implied volatility of ATM contracts of USDJPY is trading between 7.5% - 8% for 2m tenors, as the positively skewed IVs of these tenors signify the hedging sentiments for the further downside risks over the period of time, this appears to be conducive for put option holders.

This bearish sentiment is substantiated by the bearish neutral risk reversal (RRs) numbers, negative RRs indicate the hedging sentiment for the bearish risks appears to be intact.

On the flip side, it is wise to utilize abrupt rallies amid shrinking vols in the below-stated options strategy.

If you ponder upon cost effectiveness and wouldn’t like to divert exposure, we advocate buying USDJPY 2w/2m put ratio back spread strikes 109/108.388 (2 lots), (vanilla: 0.75%, spot ref: 108.253). A 2:1 put back spread can be implemented by buying a number of puts at a higher strike and buying twice the number of puts at a lower strike.

The short leg with narrowed expiry likely to benefit time decay advantage which in turn reduces hedging cost on the long leg of OTM put.

Currency Strength Index: FxWirePro's hourly USD spot index has shown 150 (which is bullish), while hourly JPY spot index was at -13 (neutral) while articulating at 10:06 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge