Chart - Courtesy Trading View

Receding hawkish Fed bets and downbeat US inflation expectations join the market jitters amid US-China tensions and SVB talks to challenge USD/JPY buyers.

Dramatic re-pricing of U.S. rate expectations weighs on the U.S. dollar. Markets slash Fed interest rate outlook even ahead of U.S. inflation data due later in the day.

Market pricing now shows a 31% chance that the Fed will keep rates on hold at its policy meeting next week, with rate cuts expected as early as June and through the end of the year.

Against a basket of currencies, the U.S. dollar index (DXY) rose 0.27% to 103.79, after sliding 0.9% on Monday and hitting a one-month low of 103.48.

Key U.S. inflation report due later on Tuesday could add to the Fed's conundrum. Core CPI is likely to remain steady at 0.4% MoM in February, YoY reading is set to tick down to 5.5%. The headline inflation is seen at 0.4% MoM and 6.0% YoY.

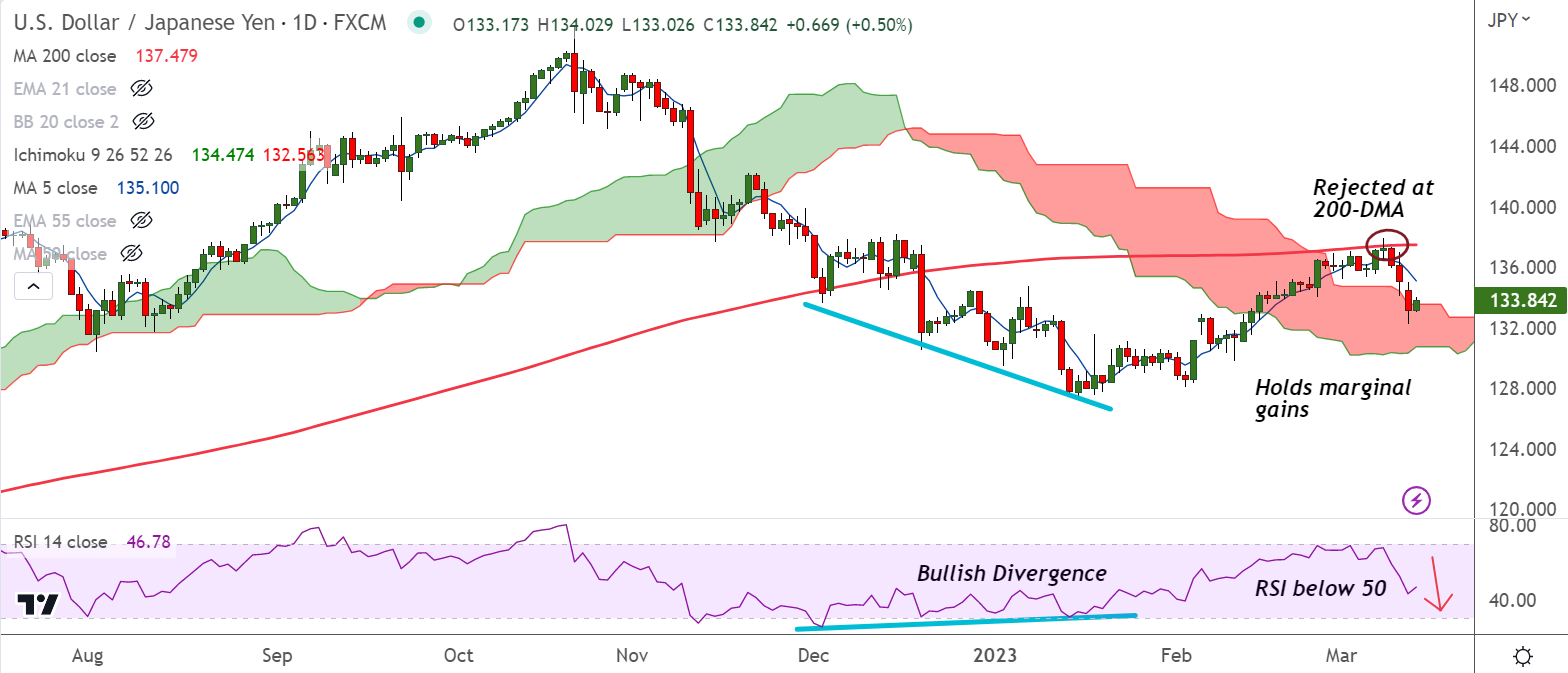

Technical Analysis:

- USD/JPY snaps 3-day bearish streak, extends marginal gains

- Momentum is bearish, Stochs and RSI are biased lower

- MACD is showing bearish crossover on signal line

- The pair hovers around daily cloud top

Major Support Levels: 133.00 (Cloud base), 132.06 (55-week EMA)

Major Resistance Levels: 134.23 (55-EMA), 135.95 (200H MA)

Summary: USD/JPY trades with a bearish technical bias. Recovery attempts lack traction. Decisive break above 55-EMA could change near-term dynamics.