USD/JPY chart - Trading View

Fundamental Overview:

Upbeat trade data from Japan released earlier today limits USD/JPY's previous day’s recovery moves.

Data released earlier today showed Japan’s February month Trade Balance grew beyond ¥917.2 B to ¥1109.8 B.

Further details suggest, Imports and Exports also beat estimates at -14.4% and -4.3% to -14% and -1% respectively.

The US Federal Reserve announced another step, a short-term credit line to primary traders, to ward off the negative implications of the Coronavirus (COVID-19).

However, downbeat comments from US Treasury Secretary Steve Mnuchin that Coronavirus outbreak could push unemployment up to 20% without action capped upside in US dollar.

Technical Analysis:

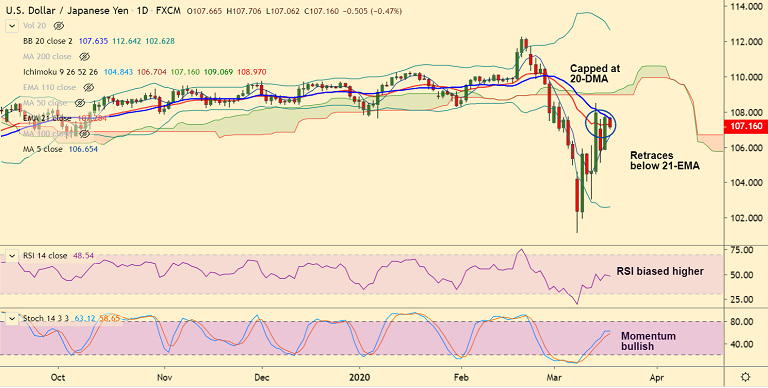

USD/JPY has slipped lower from session highs at 107.706 and was trading at 107.185, down 0.44% at 04:35 GMT.

Major trend for the pair is bearish, but minor trend is slightly bullish as evidenced by GMMA indicator.

Price action in the pair has edged above 200H MA and 5-DMA is biased higher.

Upside is capped at 20-DMA which is offering stiff resistance at 107.63. Break above could see further gains.

Next major hurdle lies at 200-DMA (currently at 108.23). Decisive break above could see further gains in the near-term.

Major Support Levels: 106.65 (5-DMA), 105.20 (200H MA)

Major Resistance Levels: 107.63 (20-DMA), 108.23 (200-DMA)

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close