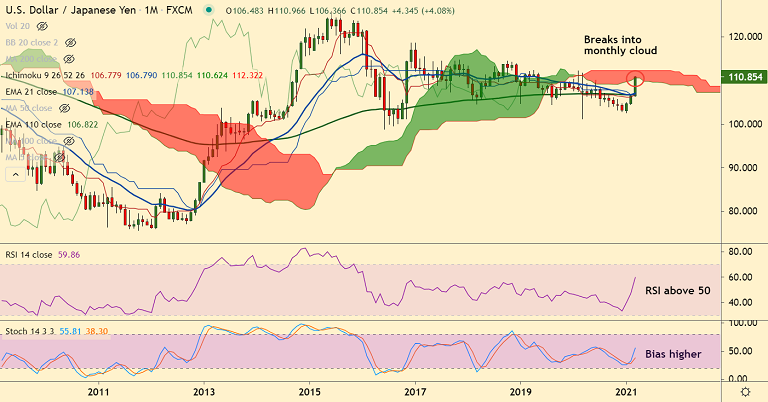

USD/JPY chart - Trading View

USD/JPY extends bull run for the 6th straight session, refreshes 12-month high above 110 handle.

US CaseShiller house prices for the month of February are up 12.0% on the year, boosted amid the low-interest rate environment.

The more important Conference Board Consumer Confidence survey for the month of March jumped to 109.7, recovering about half of the pandemic losses.

It was the largest jump since the 2008/09 financial crisis and reinforces expectations that the US economy is on the path to recovery as the vaccine rollout continues.

A pickup in US government bond yields remains the mains catalyst behind USD strength. Analysts expect a massive increase in the headline NFP this month.

Technical studies indicate a high probability for a break above 111 handle, with focus on President Joe Biden’s speech.

Major Support Levels:

S1: 110.67 (88.6% Fib)

S2: 110 (Psychological mark)

S3: 109.95 (5-DMA)

Major Resistance Levels:

R1: 111 (Psychological mark)

R2: 111.71 (March 2020 high)

R3: 112 (Psychological mark)

Summary: The major was trading 0.48% higher on the day at 110.87 at around 04:30, slipping slightly lower from session highs at 110.96. Price action has broken into monthly cloud. Scope for further upside. Next bull target 111.71.