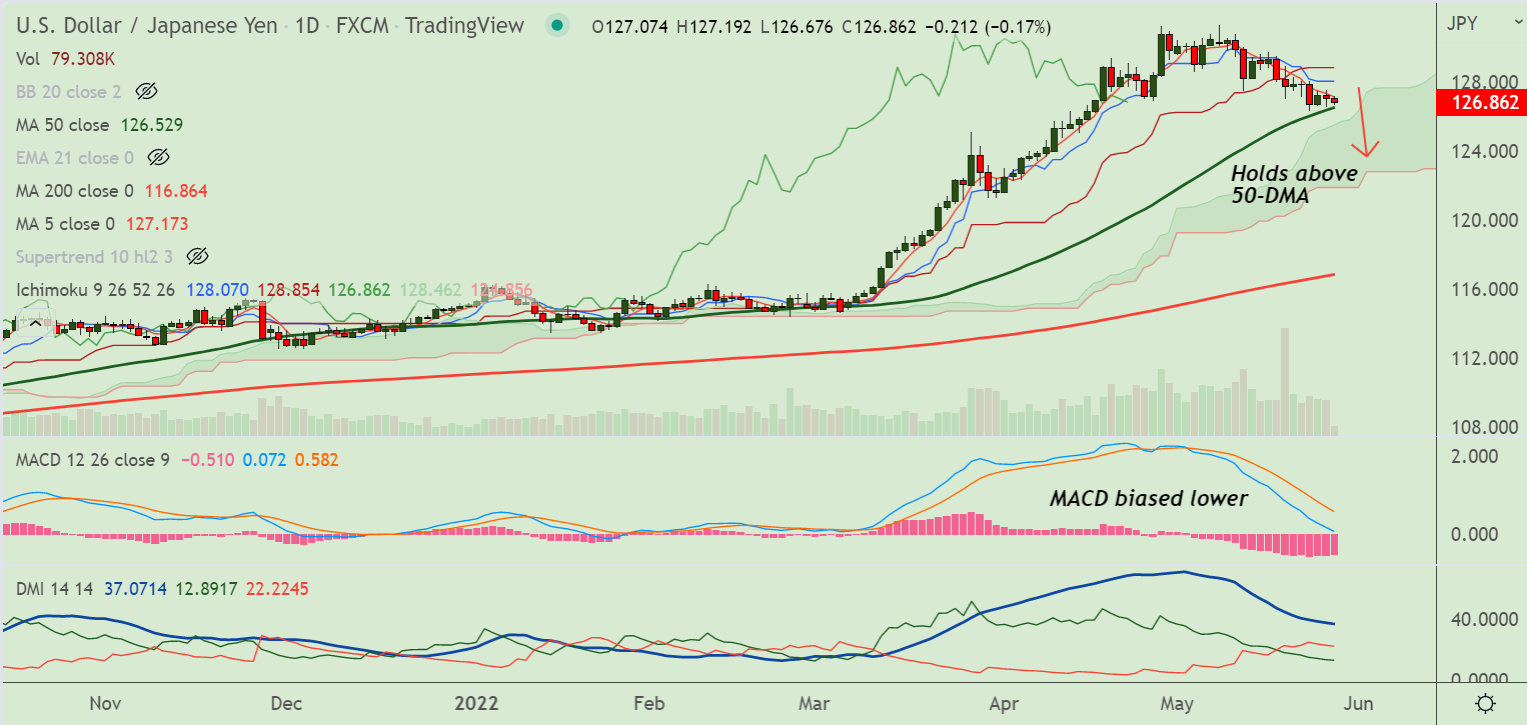

Chart - Courtesy Trading View

USD/JPY was trading 0.22% lower on the day at 126.79 at around 04:00 GMT, outlook remains bearish.

US dollar remains depressed across the board as traders lowered Fed rate hike expectations amid signs the central bank might slow or even pause its tightening cycle in the second half of the year.

Treasury yields have also dropped from multi-year highs, further undermining the dollar. UST 10 YR yield was at 2.750%, while 2 YR yield was at 2.468% at 04:05 GMT.

On the data front, US second estimate of the Q1 GDP was downwardly revised to -1.5%, worse than the previous estimate of -1.3% and missing the market's expectations of -1.4%.

Traders await the release of the US Personal Consumption Expenditure (PCE) Price Index. The annualized figure is expected to remain unchanged at 6.65 while the monthly figure could slip to 0.8%.

Technical bias for the pair is bearish. Price action has slipped below 21-EMA and is on track to test cloud support.

Major Support Levels:

S1: 126.52 (50-DMA)

S2: 125.60 (55-EMA)

Major Resistance Levels:

R1: 127.87 (200H MA)

R2: 127.95 (21-EMA)

Summary: USD/JPY trades with a bearish bias. Scope for test of daily cloud support at 126.85. Watch out for break below 50-DMA for further weakness.