The dollar rose to 123.68 yen, a two-week high, on Wednesday, before paring gains as a big fall in oil prices prompted traders to ease off on riskier trades. USD/JPY is back from 123.68 high overnight, profit-taking seen at highs, pushing the pair lower.

- However, U.S. ADP data boded well for Friday's jobs report, easing concerns sparked by a soft U.S. manufacturing data on Tuesday. Hawkish comments from Yellen overnight also keep the dollar supported

- Some option expiries in vicinity - 122.85-123.00 USD445 mln, 123.25 805 mln, another USD422 mln between 123.30-50 too, might contain market

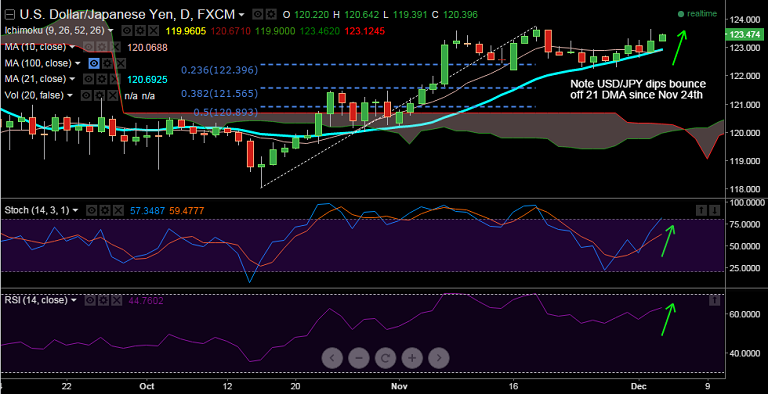

- Daily Techs are positive, daily charts show dips in the pair being contained by rising 21 DMA (now at 122.90) since Nov 24th, RSI and Stochs also point North

- 122.90 (21 DMA) is strong support on the downside, breaks below would bring next support at 122.40 (23.6 % Fibo of 118.05 - 123.75 rise) in sight

- Resistance on the upside lies at 123.65 (Daily High Nov 19) and further above at 123.67 (Dec 2nd high)

Recommendation: Good to buy dips around 123.25/30, SL: 122.85, TP: 124

Resistance Levels:

R1: 123.65 (Daily High Nov 19)

R2: 123.67 (Dec 2nd high)

R3: 123.77 (Daily High Nov 18)

R4: 124.00 (Psychological Level)

Support Levels:

S1: 122.90 (21 DMA)

S2: 122.82 (Dec 2 Low)

S3: 122.65 (Daily Low Dec 1)

S4: 122.40 (23.6 % Fibo of 118.05 - 123.75 rise)